The real estate industry has seen a surge in venture capital investment as technology and innovation reshape the market. From prop-tech startups to large-scale property developments, VC firms are fueling the future of real estate with strategic funding. In this blog, we’ll explore the top venture capital firms and investor companies that are actively backing real estate projects, helping to drive growth, efficiency, and new opportunities in the industry. Whether you’re a startup looking for funding or just curious about who’s shaping the market, this list will give you valuable insights.

Meet the Investors Shaping the Industry

Below is a list of top VC firms and investors actively funding the real estate sector. These investors are backing innovative startups, prop-tech solutions, and large-scale developments, helping to reshape the industry. From early-stage funding to multi-million-dollar investments, these firms play a crucial role in driving real estate growth and innovation. Let’s take a look at the key players and their recent investments.

1. Brick & Mortar Ventures

- Investment Stage: Early Stage Venture, Seed, Venture

- Number of Companies Invested: 83

- Number of Lead Investments: 29 (StruxHub, Rivet Work, Domatic, etc)

- Location: San Francisco, CA

- Founded Year: 2015

- Investor Type: Venture Capital

Brick & Mortar Ventures is a venture capital firm dedicated to identifying and supporting startups that bring innovation to the real estate and construction industries. Founded on January 1, 2015, and based in San Francisco, California, the firm focuses on early-stage, seed, and venture investments. With a portfolio of 83 companies and 29 lead investments, including StruxHub, Rivet Work, and Domatic, Brick & Mortar Ventures backs startups developing cutting-edge software and hardware solutions. More than just an investor, the firm provides the resources, mentorship, and industry connections needed to drive meaningful change. By enabling groundbreaking technology in real estate and construction, Brick & Mortar Ventures is shaping the future of how the world builds and operates.

2. Bienville Capital

- Investment Stage: Early Stage Venture, Late Stage Venture, Post-IPO, Private Equity, Secondary Market, Seed

- Number of Companies Invested: 83

- Number of Lead Investments: 12 (Qualia, etc)

- Location: New York

- Founded Year: 2008

- Investor Type: Hedge Fund, Incubator, Private Equity Firm, Venture Capital

Bienville Capital is a New York-based investment firm that helps innovative companies grow. Founded in December 2008, it manages capital for institutional and family office clients, focusing on a wide range of investment stages, from seed funding to post-IPO. With 83 investments and 12 lead deals, including Qualia, Bienville Capital supports startups and established businesses shaping the future of real estate. As a hedge fund, private equity firm, incubator, and venture capital investor, it provides not just funding but also strategic guidance and industry expertise. By backing bold ideas, Bienville Capital plays a key role in transforming the real estate landscape.

3. ICONIQ Capital

- Investment Stage: Early Stage Venture, Grant, Late Stage Venture, Post-IPO, Private Equity, Secondary Market, Venture

- Number of Companies Invested: 78

- Number of Lead Investments: 29 (Madison Realty Capital, etc)

- Location: San Francisco, CA

- Founded Year: 2011

- Investor Type: Family Investment Office, Private Equity Firm, Venture Capital

ICONIQ Capital is a private investment firm that helps influential families and organizations grow their wealth. Founded in 2011 and based in San Francisco, it invests across various stages, from early venture funding to private equity and post-IPO deals. With 78 investments and 29 lead deals, including Madison Realty Capital, ICONIQ Capital supports businesses shaping the future of real estate. As a family investment office, private equity firm, and venture capital investor, it provides not just funding but also strategic advice and valuable industry connections. By backing innovative companies, ICONIQ Capital plays a key role in transforming the real estate sector.

4. Trucks Venture Capital

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed

- Number of Companies Invested: 72

- Number of Lead Investments: 20 (Treehouse)

- Location: San Francisco, CA

- Founded Year: 2015

- Investor Type: Micro VC, Venture Capital

Trucks Venture Capital is a San Francisco-based investment firm focused on shaping the future of transportation and infrastructure. Founded on December 1, 2015, it supports early-stage, late-stage, and seed startups that are driving innovation in mobility, logistics, and urban development. With 72 investments and 20 lead deals, including Treehouse, the firm backs companies that influence real estate and smart city planning. As a micro VC and venture capital firm, Trucks Venture Capital provides funding, industry expertise, and strategic connections to help startups succeed. Investing in cutting-edge solutions, it plays a key role in transforming how cities and communities evolve.

5. Camber Creek

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 71

- Number of Lead Investments: 19 (SERHANT, Measurabl, Curbio, etc)

- Location: Rockville, MD

- Founded Year: 2009

- Investor Type: Venture Capital

Camber Creek is a venture capital firm dedicated to driving innovation in the real estate industry. Founded in 2009 and based in Rockville, MD, it invests in early-stage, late-stage, and seed startups that are transforming how properties are bought, sold, and managed. With 71 investments and 19 lead deals, including SERHANT, Measurabl, and Curbio, Camber Creek provides both funding and expert advisory services to help businesses grow. Backward-thinking companies play a key role in shaping the future of real estate through technology and smart solutions.

6. Creative Ventures

- Investment Stage: Early Stage Venture, Seed, Venture

- Number of Companies Invested: 60

- Number of Lead Investments: 11 (Terra CO2 Technologies, etc)

- Location: Oakland, CA

- Founded Year: 2016

- Investor Type: Venture Capital

Creative Ventures is a deep tech venture capital firm that invests in early-stage companies tackling major global challenges, including real estate and infrastructure. Founded on January 1, 2016, and based in Oakland, CA, the firm focuses on seed and early-stage ventures that bring innovative solutions to the industry. With 60 investments and 11 lead deals, including Terra CO2 Technologies, Creative Ventures backs companies that improve sustainability, efficiency, and technology in real estate. More than just funding, it provides expert guidance and strategic support to help startups succeed. By investing in groundbreaking ideas, Creative Ventures is shaping the future of real estate and beyond.

7. WestCap

- Investment Stage: Early Stage Venture, Late Stage Venture, Private Equity

- Number of Companies Invested: 60

- Number of Lead Investments: 41 (Valon Technologies, Avenue One, Point, etc)

- Location: New York

- Founded Year: 2019

- Investor Type: Private Equity Firm, Venture Capital

WestCap is a New York-based investment firm that helps innovative companies grow in real estate and other industries. Founded in 2019, it focuses on early-stage, late-stage, and private equity investments, backing tech-driven, asset-light marketplaces. With 60 investments and 41 lead deals, including Valon Technologies, Avenue One, and Point, WestCap supports startups that make real estate smarter and more efficient. As both a private equity and venture capital firm, it provides funding, expertise, and strategic guidance to help businesses scale. By investing in forward-thinking companies, WestCap is shaping the future of real estate and technology.

8. RET Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed

- Number of Companies Invested: 57

- Number of Lead Investments: 38 (Juno, Lula, Picket Homes, etc)

- Location: Park City, UT

- Founded Year: 2017

- Investor Type: Venture Capital

RET Ventures is a venture capital firm dedicated to driving innovation in real estate technology. Founded in September 2017 and based in Park City, Utah, it focuses on seed, early-stage, and late-stage investments that improve how properties are managed, rented, and sold. With 57 investments and 38 lead deals, including Juno, Lula, and Picket Homes, RET Ventures backs startups developing smart solutions for the real estate industry. More than just funding, it provides expert guidance and strong industry connections to help companies succeed. By supporting groundbreaking technology, RET Ventures is shaping the future of real estate.

9. J-Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed

- Number of Companies Invested: 55

- Number of Lead Investments: 2 (Home365)

- Location: Palo Alto, CA

- Founded Year: 2016

- Investor Type: Venture Capital

J-Ventures is a venture capital firm that supports innovative startups in real estate and beyond. Founded in 2016 and based in Palo Alto, CA, it invests in seed, early-stage, and late-stage companies that are shaping the future of the industry. With 55 investments and 2 lead deals, including Home365, J-Ventures provides funding and strategic guidance to help businesses grow. As an LP-driven venture capital fund, it connects entrepreneurs with valuable resources and industry expertise. By backing forward-thinking companies, J-Ventures is playing a key role in transforming real estate through technology and smart investments.

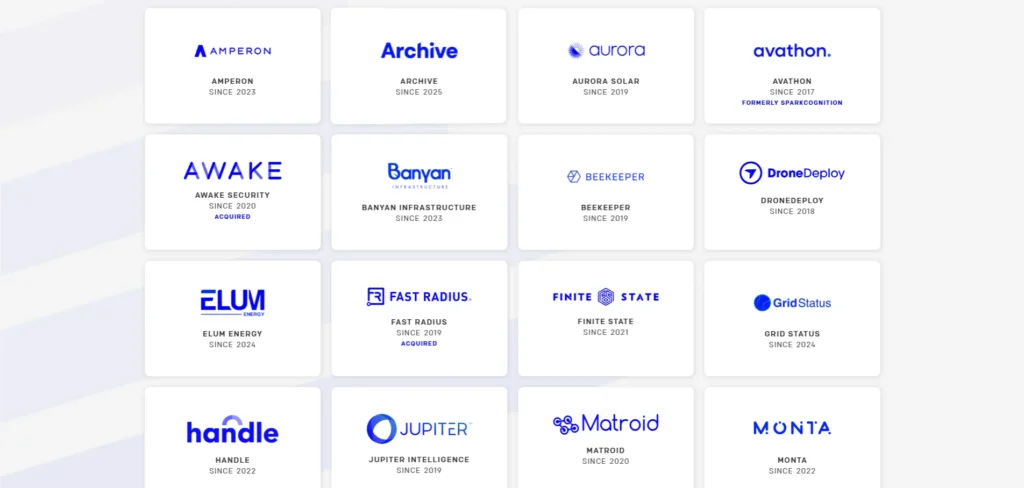

10. Energize Capital

- Investment Stage: Early Stage Venture, Late Stage Venture, Venture

- Number of Companies Invested: 50

- Number of Lead Investments: 35 (Urbint, Handle, etc)

- Location: Chicago, IL

- Founded Year: 2016

- Investor Type: Venture Capital

Energize Capital is a venture capital firm focused on the future of energy, sustainability, and real estate technology. Founded in 2016 and based in Chicago, IL, it invests in early-stage and late-stage companies that are driving innovation in these industries. With 50 investments and 35 lead deals, including Urbint and Handle, Energize Capital supports startups that make buildings and cities smarter, greener, and more efficient. Beyond funding, the firm provides strategic guidance and industry connections to help businesses grow. By backing cutting-edge solutions, Energize Capital is helping shape a more sustainable and tech-driven real estate industry.

11. Sopris Capital Associates

- Investment Stage: Early Stage Venture, Post-IPO, Venture

- Number of Companies Invested: 50

- Number of Lead Investments: 30 (Anyone Home, Click Notices, etc)

- Location: Denver, CO

- Founded Year: 2002

- Investor Type: Private Equity Firm, Venture Capital

Sopris Capital Associates is a Denver-based investment firm that provides growth capital to innovative businesses in real estate, healthcare, and technology-enabled services. Founded in 2002, it focuses on early-stage, post-IPO, and venture investments that drive industry transformation. With 50 investments and 30 lead deals, including Anyone Home and Click Notices, Sopris Capital backs companies that improve real estate operations and services. As both a private equity and venture capital firm, it offers funding, strategic insights, and industry connections to help businesses scale. By supporting forward-thinking companies, Sopris Capital is shaping the future of real estate and beyond.

12. Nine Four Ventures

- Investment Stage: Early Stage Venture, Venture

- Number of Companies Invested: 40

- Number of Lead Investments: 4 (First, Inspectify, etc)

- Location: Chicago, IL

- Founded Year: 2018

- Investor Type: Venture Capital

Nine Four Ventures is a Chicago-based venture capital firm dedicated to transforming real estate through technology. Founded in 2018, it focuses on early-stage investments in PropTech startups that improve how properties are bought, sold, and managed. With 40 investments and 4 lead deals, including First and Inspectify, Nine Four Ventures backs companies that bring smart solutions to the real estate industry. More than just funding, it provides expert guidance and strategic support to help businesses grow. By investing in cutting-edge technology, Nine Four Ventures is shaping the future of real estate.

13. Suffolk Technologies

- Investment Stage: Early Stage Venture, Late Stage Venture

- Number of Companies Invested: 39

- Number of Lead Investments: 4 (Ediphi, Handle, Trayd, etc)

- Location: Boston, MA

- Founded Year: 2019

- Investor Type: Accelerator, Venture Capital

Suffolk Technologies is a venture capital platform based in Boston, MA, that invests in the next generation of companies addressing challenges in the built environment. Founded in 2019, it focuses on early and late-stage investments in startups that bring innovative solutions to real estate and construction. With 39 investments and 4 lead deals, including Ediphi, Handle, and Trayd, Suffolk Technologies supports businesses that are reshaping the way buildings and infrastructure are designed, built, and managed. By providing funding and strategic guidance, Suffolk Technologies is helping to drive the future of real estate technology and sustainability.

14. Tamarisc Ventures

- Investment Stage: Early Stage Venture, Seed

- Number of Companies Invested: 36

- Number of Lead Investments: 11 (Breezeway, Serraview, Getaway, etc)

- Location: Irvine, CA

- Founded Year: 2014

- Investor Type: Micro VC, Venture Capital

Tamarisc Ventures is a micro VC firm based in Irvine, CA, that invests in early-stage real estate technology companies. Founded in 2014, it focuses on startups that are transforming the way we live, work, and travel within the built environment. With 36 investments and 11 lead deals, including Breezeway, Serraview, and Getaway, Tamarisc Ventures backs companies that improve real estate experiences through innovative technology. By providing both funding and strategic support, it helps these businesses grow and reshape the future of real estate. Tamarisc Ventures is committed to backing solutions that make our built environments smarter and more efficient.

15. Prudence

- Investment Stage: Early Stage Venture, Late Stage Venture, Private Equity, Seed

- Number of Companies Invested: 33

- Number of Lead Investments: 15 (Clearstory.build, Crexi, Evernest, etc)

- Location: New York

- Founded Year: 2009

- Investor Type: Venture Capital

Prudence is a venture capital firm based in New York that focuses on investing in technology companies driving the global transformation of the built world. Founded in 2009, Prudence supports early-stage, late-stage, and seed investments in real estate tech startups. With 33 investments and 15 lead deals, including Clearstory. build, Crexi, and Evernest, the firm helps companies create smarter, more efficient real estate solutions. By providing funding and strategic guidance, Prudence is shaping the future of the built environment, supporting innovative technology that improves how we live and work.

16. Shadow Ventures

- Investment Stage: Early Stage Venture, Seed

- Number of Companies Invested: 30

- Number of Lead Investments: 9 (Green Badger, Billy, Stake, etc)

- Location: Atlanta, GA

- Founded Year: 2018

- Investor Type: Accelerator, Venture Capital

Shadow Ventures is a venture capital firm based in Atlanta, GA, dedicated to investing in technology that sparks innovation in the built environment. Founded in 2018, it focuses on early-stage and seed investments, supporting startups that are changing the way we design, build, and manage real estate. With 30 investments and 9 lead deals, including Green Badger, Billy, and Stake, Shadow Ventures helps companies develop cutting-edge solutions for the construction and real estate industries. By providing funding and expertise, Shadow Ventures is helping shape the future of how we live and work in the built world.

17. Ironspring Ventures

- Investment Stage: Early Stage Venture, Seed

- Number of Companies Invested: 30

- Number of Lead Investments: 12 (Handle, GoContractor, etc)

- Location: Austin, TX

- Founded Year: 2019

- Investor Type: Venture Capital

Ironspring Ventures is a venture capital firm based in Austin, TX, that focuses on early-stage and seed investments in industries shaping the built world. Founded in 2019, the firm specializes in construction, manufacturing, transport, logistics, and alternative energy. With 30 investments and 12 lead deals, including Handle and GoContractor, Ironspring Ventures helps innovative startups grow and transform these critical industries. By providing funding, strategic support, and industry expertise, the firm is committed to driving progress and building a smarter, more efficient future.

18. Great Wave Ventures

- Investment Stage: Early Stage Venture, Seed, Venture

- Number of Companies Invested: 30

- Number of Lead Investments: 4 (Raccord)

- Location: New York, NY

- Founded Year: 2020

- Investor Type: Venture Capital

Great Wave Ventures is a New York-based venture capital firm dedicated to shaping the future of the built world. Founded in 2020, the firm focuses on early-stage and seed investments, supporting innovative startups that are redefining real estate and construction. With 30 investments and key lead deals like Raccord, Great Wave Ventures provides funding, guidance, and strategic partnerships to help visionary entrepreneurs succeed. By backing cutting-edge solutions, the firm plays a vital role in driving progress and transforming how we live and build.

19. Goldman Sachs Merchant Banking Division

- Investment Stage: Debt, Early Stage Venture, Late Stage Venture, Private Equity, Venture

- Number of Companies Invested: 27

- Number of Lead Investments: 22 (Inhabit)

- Location: New York, NY

- Founded Year: 1998

- Investor Type: Investment Bank, Private Equity Firm, Venture Capital

Goldman Sachs Merchant Banking Division is a powerhouse in private equity and venture capital, providing both equity and credit investments to fuel business growth. Founded in 1998 and based in New York, the firm has backed 27 companies, leading investments in key players like Inhabit. With a focus on real estate and other industries, it helps businesses scale by offering financial support, strategic expertise, and deep market insights. By investing in innovative ventures, the Goldman Sachs Merchant Banking Division continues to shape the future of the real estate sector and beyond.

20. Heartland Ventures

- Investment Stage: Early Stage Venture, Seed, Venture

- Number of Companies Invested: 25

- Number of Lead Investments: 6 (Soil Connect)

- Location: Columbus, OH

- Founded Year: 2016

- Investor Type: Venture Capital

Heartland Ventures is a venture capital firm that helps high-growth startups connect with new customers in the Midwest. Founded in 2016 and based in Columbus, Ohio, the firm focuses on early-stage investments, including real estate technology. With 25 companies in its portfolio and key investments like Soil Connect, Heartland Ventures provides more than just funding—it opens doors to valuable industry connections and business opportunities. By bridging the gap between innovative startups and the Midwest market, the firm plays a key role in shaping the future of real estate and beyond.

21. Reimagined Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture, Private Equity, Seed, Venture

- Number of Companies Invested: 24

- Number of Lead Investments: 6 (Mobile Doorman)

- Location: Winnetka, IL

- Founded Year: 2016

- Investor Type: Family Investment Office, Private Equity Firm, Venture Capital

Reimagined Ventures is a Chicago-based investment firm that supports innovative companies shaping the future of real estate. Founded in 2016, the firm provides funding at various stages, from early investments to private equity. With key investments like Mobile Doorman, Reimagined Ventures focuses on backing promising startups that bring new ideas to the built world. By combining financial support with strategic guidance, the firm helps businesses grow and thrive in the ever-evolving real estate market.

22. Zacua Ventures

- Investment Stage: Early Stage Venture, Seed

- Number of Companies Invested: 20

- Number of Lead Investments: 8 (Sitewire, Pathways Technologies, Concrete4Change, etc)

- Location: Burlingame, CA

- Founded Year: 2022

- Investor Type: Venture Capital

Zacua Ventures is a forward-thinking venture capital firm dedicated to supporting the next generation of real estate innovators. Founded in 2022 and based in Burlingame, CA, the firm focuses on early-stage investments in companies reshaping the built environment. With key investments in startups like Sitewire and Concrete4Change, Zacua Ventures backs entrepreneurs who bring fresh ideas to construction, infrastructure, and property technology. By providing both funding and strategic guidance, the firm helps these companies grow and create lasting change in the industry.

23. Parker89

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed

- Number of Companies Invested: 19

- Number of Lead Investments: 2 (Lev, Orbital Witness, etc)

- Location: Los Angeles, CA

- Founded Year: 2019

- Investor Type: Corporate Venture Capital, Venture Capital

Parker89 is a venture capital firm that backs entrepreneurs reshaping residential and commercial real estate. Based in Los Angeles and founded in 2019, the firm invests in both early and late-stage startups that bring fresh ideas to the industry. With key investments in companies like Lev and Orbital Witness, Parker89 supports innovation in real estate technology and services. By providing funding and expert guidance, the firm helps visionary founders turn their ideas into impactful solutions for the future of real estate.

24. Colchis Capital Management

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 16

- Number of Lead Investments: 4 (PeerStreet, etc)

- Location: San Francisco, CA

- Founded Year: 2005

- Investor Type: Venture Capital

Colchis Capital Management is a venture capital firm based in San Francisco, California, founded in 2005. The firm focuses on acquiring private and income-oriented assets and investing in early-stage, late-stage, seed, and venture opportunities. With a total of 16 investments and 4 lead investments, including PeerStreet, Colchis Capital Management plays a key role in funding and supporting innovative companies in the real estate sector. Their expertise in strategic investments helps businesses grow while driving transformation in the built environment.

25. Valmiki Capital Management

- Investment Stage: Early Stage Venture, Late Stage Venture, Private Equity, Seed

- Number of Companies Invested: 15

- Number of Lead Investments: 12 (BuildForward Capital LLC, etc)

- Location: New York, NY

- Founded Year: 2005

- Investor Type: Private Equity Firm, Venture Capital

Valmiki Capital Management is a New York-based investment firm founded in 2005. Specializing in venture capital and private equity, the firm serves as an investment manager for multiple funds across various sectors. With 15 investments and 12 lead investments, including BuildForward Capital LLC, Valmiki Capital actively supports innovative companies in real estate and beyond. Their strategic approach helps businesses grow while shaping the future of the investment landscape.

26. Saluda Grade

- Investment Stage: Early Stage Venture

- Number of Companies Invested: 7

- Number of Lead Investments: 4 (Wrightwell, Hillcrest Finance, etc)

- Location: New York

- Founded Year: 2019

- Investor Type: Private Equity Firm, Venture Capital

Saluda Grade is a New York-based private equity and venture capital firm specializing in real estate, mortgage, and alternative credit investments. Founded in 2019, the firm acts as an alternative real estate advisory company, focusing on the mortgage and alternative credit space. Saluda Grade primarily invests in early-stage ventures, supporting companies that drive innovation in the real estate sector. With seven investments and four lead investments, including Wrightwell and Hillcrest Finance, the firm plays a crucial role in shaping the future of real estate finance. By leveraging its deep industry expertise and strategic approach, Saluda Grade helps businesses grow while transforming the built environment.

27. Moderne Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture, Private Equity

- Number of Companies Invested: 105

- Number of Lead Investments: 14 (LiveEasy, Silvernest, The Suburban Jungle Group, etc)

- Location: Chicago, IL

- Founded Year: 2015

- Investor Type: Accelerator, Private Equity Firm, Venture Capital

Moderne Ventures is a strategic venture capital and growth equity firm based in Chicago, founded in 2015. Specializing in real estate investments, the firm focuses on both early and late-stage ventures, helping businesses scale and thrive in the ever-evolving real estate market. With over 100 companies invested in, including lead investments in LiveEasy, Silvernest, and The Suburban Jungle Group, Moderne Ventures plays a key role in transforming the industry. Their approach combines expertise, innovation, and a strong network, making them a vital partner for companies shaping the future of real estate.

28. Hyperplane

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 94

- Number of Lead Investments: 26 (Aryeo, etc)

- Location: Boston, MA

- Founded Year: 2014

- Investor Type: Venture Capital

Hyperplane is a venture capital firm based in Boston, founded in 2014. The firm specializes in backing exceptional founders who are building machine intelligence and data-driven companies. With a portfolio of 94 companies, Hyperplane has made 26 lead investments, including notable names like Aryeo. The firm focuses on early-stage to late-stage ventures, providing support for companies across various industries, including real estate. Hyperplane’s strategic investments aim to drive innovation in the built environment, helping reshape industries by leveraging advanced technology and data solutions to create a lasting impact.

Conclusion

The real estate industry is evolving rapidly, driven by innovation and technology. These venture capital firms play a crucial role in supporting startups that are transforming the built world. As investment continues to flow into PropTech, the future of real estate looks smarter, more efficient, and increasingly data-driven.

FAQs

Q. What is a real estate venture capital firm?

Answer: A real estate venture capital (VC) firm invests in startups and companies that are innovating in the real estate sector, including PropTech, construction, and property management solutions.

Q. How do VC firms support real estate startups?

Answer: VC firms provide funding, mentorship, and industry connections to help startups grow and scale their businesses in the competitive real estate market.

Q. How do real estate startups attract VC funding?

Answer: Startups need a strong business model, innovative technology, market demand, and a scalable solution to attract investment from VC firms.