The blockchain space is booming, with innovative startups securing major investments to fuel their growth. These 10 blockchain startups have recently raised $50M to $100M, positioning themselves as key players in decentralized finance, smart contracts, and enterprise blockchain solutions.

From NFT platforms to blockchain scalability solutions, these startups are pushing the boundaries of what blockchain can do.

Meet 10 Blockchain Startups Transforming the Industry With $50M-$100M in Funding

Discover how these blockchain startups are leading the way in the next wave of digital innovation.

Let’s explore 10 blockchain startups that have raised between $50 million and $100 million and are ready to shape the future of the industry!

| Company | Founded | Location | Employees | Last Funding | Last Funding Date | Total Funding |

|---|---|---|---|---|---|---|

| Polymarket | 2020 | New York, NY, USA | 11-50 | $45M | May 14, 2024 | $74M |

| Eclipse | 2022 | San Francisco, CA, USA | 11-50 | $50M | Mar 11, 2024 | $65M |

| Chaos Labs | 2022 | New York, NY, USA | 11-50 | $55M | Aug 15, 2024 | $75M |

| Azra Games | 2022 | Sacramento, CA, USA | 11-50 | $42.7M | Oct 15, 2024 | $67.7M |

| Zora | 2020 | Los Angeles, CA, USA | 11-50 | $2.62M | May 9, 2024 | $62.62M |

| Figure Markets | 2024 | San Francisco, CA, USA | 101-250 | $60M | Mar 18, 2024 | $60M |

| Espresso Systems | 2020 | Menlo Park, CA, USA | 11-50 | $28M | Mar 21, 2024 | $63.1M |

| Avail | 2023 | Dubai, UAE | 11-50 | Non Disclosure | Jun 12, 2024 | $75M |

| Morpho Labs | 2021 | Paris, France | 11-50 | $50M | Aug 1, 2024 | $68M |

| Drift Protocol | 2021 | Sydney, Australia | 11-50 | $25M | Sep 19, 2024 | $52.3M |

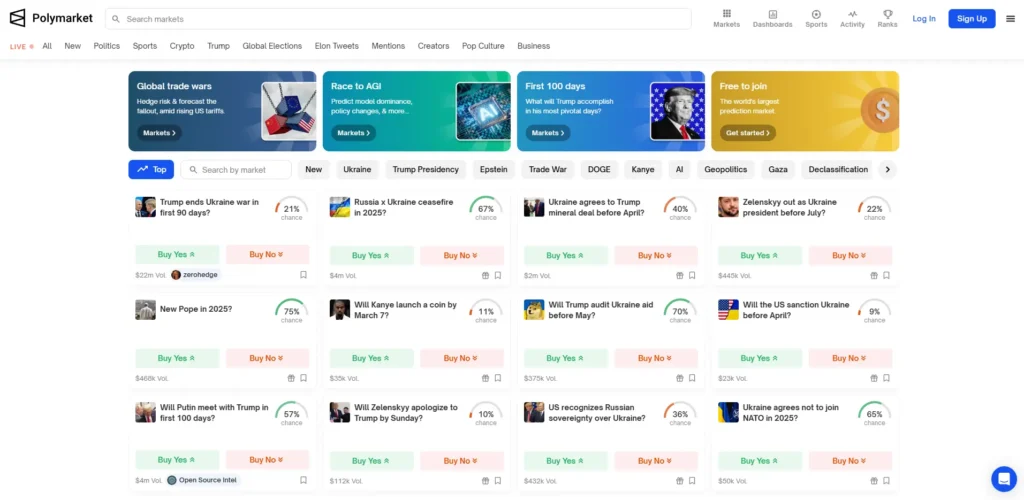

1. Polymarket

- Founded: March 2020

- Location: New York, New York, USA

- Industry: Blockchain, Cryptocurrency, Predictive Analytics

- Number of Employees: 11-50

- Last Funding Amount: $45M (Latest Round: May 14, 2024)

- Total Funding Amount: $74M

Polymarket is a cutting-edge prediction market platform that allows users to place bets on the outcomes of global events using cryptocurrency. Operating on the Ethereum blockchain and utilizing the Polygon network for enhanced scalability, Polymarket offers a decentralized and efficient platform for real-time predictions. Through the use of the USDC stablecoin, users can bet on a variety of events, from political outcomes to entertainment predictions, making it a unique space for trading on future events.

2. Eclipse

- Founded: September 2022

- Location: San Francisco, California, USA

- Industry: Blockchain, Ethereum

- Number of Employees: 11-50

- Last Funding Amount: $50M (Latest Round: March 11, 2024)

- Total Funding Amount: $65M

Eclipse is pioneering the Ethereum ecosystem with its Solana Virtual Machine Layer 2 (L2), providing unmatched performance improvements over existing L2 networks. While other Ethereum L2s focus on Ethereum Virtual Machine (EVM) compatibility, Eclipse leverages innovations from Solana’s Layer 1 to create a high-performance solution for Ethereum, incorporating enhanced verification features for deploying the blockchain as a rollup. Eclipse’s team consists of industry veterans from dYdX, Uniswap, Citadel, and Airbnb, and the company is supported by leading investors, including Polychain, Placeholder, and DBA.

3. Chaos Labs

- Founded: 2022

- Location: New York, New York, USA

- Industry: Blockchain, Risk Management, Software

- Number of Employees: 11-50

- Last Funding Amount: $55M (Latest Round: August 15, 2024)

- Total Funding Amount: $75M

Chaos Labs is a fully automated on-chain economic security system designed to help crypto protocols optimize risk management and capital efficiency while safeguarding user funds. By offering secure and safe operating environments, Chaos Labs empowers crypto protocols to navigate volatile markets and make informed decisions. The platform is currently available for protocols on the Ethereum network, with future plans to expand to blockchains like Terra, NEAR, and Polygon. The company leverages technology and risk management expertise to provide high-fidelity agent and scenario-based simulations on mainnet forks.

4. Azra Games

- Founded: 2022

- Location: Sacramento, California, USA

- Industry: Blockchain, Cryptocurrency, Gaming

- Number of Employees: 11-50

- Last Funding Amount: $42.7M (Latest Round: October 15, 2024)

- Total Funding Amount: $67.7M

Azra Games is a blockchain-based developer specializing in collectible combat role-playing games (RPGs) for core gamers. The company combines blockchain technology with gaming to create a new way for gamers to create, play, collect, trade, and socialize. The RPGs feature various characters, enabling a shift in how games are experienced and interacted with. Azra Games was founded in 2022 by Sonny Mayugba in Sacramento, California.

5. Zora

- Founded: 2020

- Location: Los Angeles, California, USA

- Industry: Blockchain, Cryptocurrency, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $2.62M (Latest Round: May 9, 2024)

- Total Funding Amount: $62.62M

Zora Labs is a marketplace for non-fungible tokens (NFTs) that allows creators to tokenize and sell digital files including photos, videos, audio, and music. The platform uses blockchain technology to provide secondary market value to these digital assets and features drop alerts and notifications to keep users informed. Zora Labs was founded in 2020 and is headquartered in Los Angeles, California.

6. Figure Markets

- Founded: 2024

- Location: San Francisco, California, USA

- Industry: Blockchain

- Number of Employees: 101-250

- Last Funding Amount: $60M (Latest Round: March 18, 2024)

- Total Funding Amount: $60M

Figure Markets is at the forefront of reshaping private capital markets through blockchain technology. By utilizing blockchain, the company provides enhanced security, transparency, and efficiency, transforming the way private capital is raised, traded, and managed. Figure Markets aims to bridge the gap between traditional financial systems and the rapidly evolving digital economy, offering innovative solutions for both investors and companies. Its platform offers an efficient, scalable alternative to conventional methods, making private capital markets more accessible and inclusive for businesses and investors alike.

7. Espresso Systems

- Founded: 2020

- Location: Menlo Park, California, USA

- Industry: Blockchain, Cyber Security, Information Technology

- Number of Employees: 11-50

- Last Funding Amount: $28M (Latest Round: March 21, 2024)

- Total Funding Amount: $63.1M

Espresso Systems is a leading provider of scaling and privacy solutions for Web 3 applications. Specializing in the emerging field of “shared sequencing,” Espresso focuses on enhancing blockchain scalability and security by enabling sequencers to verify and batch transactions made on layer-2 blockchains, before settling them on layer-1 chains like Ethereum. The company’s innovative technology aims to drive the growth and performance of Web 3 applications, supporting secure, efficient, and scalable decentralized systems. Espresso Systems is paving the way for the future of blockchain infrastructure, ensuring privacy and scalability for next-generation decentralized applications.

8. Avail

- Founded: March 2023

- Location: Dubai, United Arab Emirates

- Industry: Blockchain

- Number of Employees: 11-50

- Last Funding Amount: Non Disclosure (Latest Round: June 12, 2024)

- Total Funding Amount: $75M

Avail is a forward-thinking blockchain project focused on building decentralized solutions for the next generation of the internet. The project’s mission is to create scalable and efficient blockchain systems that enable seamless digital experiences while addressing key issues such as security, transparency, and data privacy. With a focus on empowering users and businesses, Avail’s innovative approach aims to unlock new possibilities for decentralized applications (dApps), ensuring that users remain in control of their data. By leveraging the power of blockchain, Avail is shaping the future of decentralized technology.

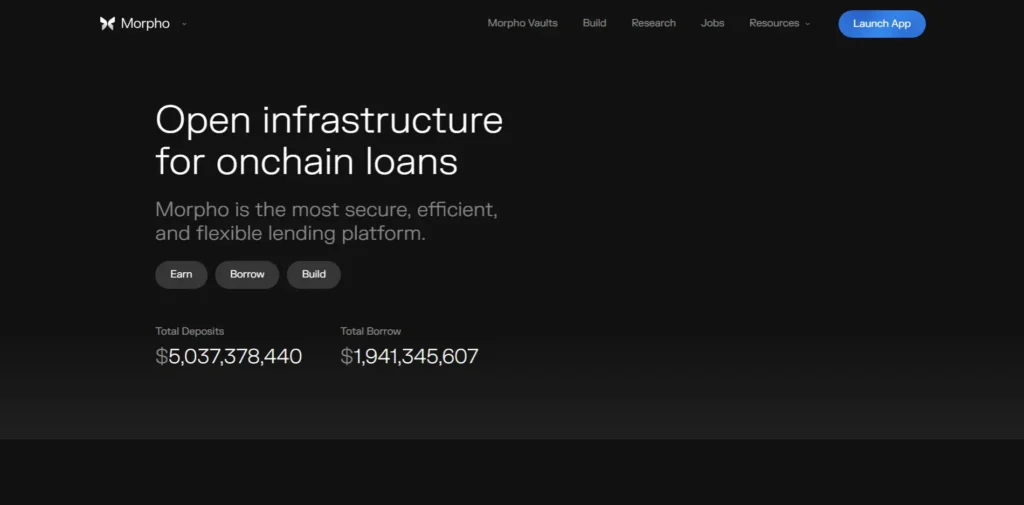

9. Morpho Labs

- Founded: 2021

- Location: Paris, Ile-de-France, France

- Industry: Blockchain, Cryptocurrency, Financial Services

- Number of Employees: 11-50

- Last Funding Amount: $50M (Latest Round: August 1, 2024)

- Total Funding Amount: $68M

Morpho Labs is revolutionizing the financial services industry by leveraging blockchain and cryptocurrency technologies to enhance decentralized finance (DeFi) platforms. The company focuses on creating innovative solutions that optimize lending and borrowing markets by enhancing capital efficiency and improving user experience. Through advanced cryptographic techniques and decentralized protocols, Morpho Labs aims to provide financial services that are more accessible, transparent, and secure. The company’s vision is to drive the growth of DeFi while solving real-world financial problems through the power of blockchain.

10. Drift Protocol

- Founded: 2021

- Location: Sydney, New South Wales, Australia

- Industry: Blockchain, Internet

- Number of Employees: 11-50

- Last Funding Amount: $25M (Latest Round: September 19, 2024)

- Total Funding Amount: $52.3M

Drift Protocol is a decentralized exchange (DEX) built on blockchain technology, offering innovative trading solutions that empower users with greater control over their assets. The platform specializes in providing a highly scalable, low-latency trading experience for the cryptocurrency community. With an emphasis on secure and seamless trading, Drift Protocol is designed to enhance liquidity and provide users with advanced features like margin trading and perpetual contracts. By leveraging blockchain’s transparency and decentralization, Drift aims to transform the digital trading space, ensuring a user-first approach to decentralized finance (DeFi).

Conclusion

The $50M-$100M raised by 10 blockchain startups marks a significant leap in the blockchain space. These companies are at the forefront of blockchain innovation, focusing on areas such as decentralized finance (DeFi), supply chain transparency, smart contracts, and more. With substantial funding, they are poised to revolutionize various industries, offering more secure, transparent, and efficient solutions.

FAQs

Q. What industries are blockchain startups disrupting?

Answer: Blockchain startups are disrupting multiple industries, including:

- Decentralized Finance (DeFi): Enabling peer-to-peer financial transactions and enhancing security and transparency.

- Gaming: Using blockchain for digital asset ownership and NFT-based gaming.

- Supply Chain Management: Improving transparency, efficiency, and traceability.

- Data Privacy & Security: Providing secure data-sharing solutions and enhancing privacy for digital assets.

Q. What can we expect from these blockchain startups in the future?

Answer: In the future, these startups are likely to continue innovating and expanding their offerings. We can expect more decentralized applications, greater integration with existing industries, enhanced security measures, and more user-friendly solutions that cater to a broader audience.

Q. Can I invest in these blockchain startups?

Answer: While some of these companies are still in their growth stages, many may eventually offer investment opportunities through venture capital firms, initial coin offerings (ICOs), or equity rounds. Interested investors should keep an eye on funding announcements or IPOs for these companies.