The financial services sector is seeing a surge of innovation from new startups that are reshaping the industry. These 20 companies, founded after 2020, have secured $1M to $5M in funding to scale their fintech solutions, including digital banking, payments, and investment platforms.

From AI-driven lending to neobanks and blockchain solutions, these startups are driving change and creating more efficient, accessible financial systems.

Meet 20 Rising Financial Services Startups That Raised $1M–$5M

Discover how these financial services startups are revolutionizing how we manage money and engage with financial technologies.

Let’s take a closer look at the rising stars making waves in the financial sector.

| Company Name | Founded | Location | Number of Employees | Last Funding | Last Funding Date | Total Funding |

|---|---|---|---|---|---|---|

| Juicyway | 2021 | Wilmington, DE, USA | 11-50 | $3M | Dec 16, 2024 | $3M |

| Sandbox Wealth | 2023 | New York, NY, USA | 1-10 | $1.25M | Dec 4, 2024 | $1.25M |

| Billboxx | 2023 | New York, NY, USA | 1-10 | $1.6M | Dec 11, 2024 | $1.8M |

| Cofactor AI | 2023 | Chicago, IL, USA | 1-10 | $4M | Nov 25, 2024 | $4M |

| Offcall | 2024 | San Francisco, CA, USA | 1-10 | $2M | Dec 4, 2024 | $2M |

| Wasabi | 2022 | New York, NY, USA | 1-10 | $3M | Jun 17, 2024 | $3M |

| Tab Commerce | 2021 | Austin, TX, USA | 11-50 | $2.5M | Sep 9, 2024 | $3.75M |

| AgentSmyth | 2024 | New York, NY, USA | 1-10 | $2.5M | Apr 17, 2024 | $2.5M |

| Uprise | 2021 | San Francisco, CA, USA | 1-10 | $3.3M | Oct 21, 2024 | $4.7M |

| Hapax | 2024 | Austin, TX, USA | 11-50 | $2.6M | Apr 3, 2024 | $2.6M |

| RubyWell | 2023 | New York, NY, USA | 1-10 | $1.11M | Oct 17, 2024 | $1.11M |

| Talli Digital Payments | 2024 | New York, NY, USA | 1-10 | $4M | Nov 11, 2024 | $4M |

| FutureMoney | 2023 | Boston, MA, USA | 1-10 | $2.5M | Oct 9, 2024 | $2.5M |

| Revenew | 2023 | San Francisco, CA, USA | 1-10 | $4.55M | Aug 22, 2024 | $4.55M |

| Adro | 2023 | New York, NY, USA | 1-10 | $1.5M | Apr 9, 2024 | $1.5M |

| Neptune | 2024 | New York, NY, USA | 1-10 | $2.5M | Sep 19, 2024 | $2.5M |

| Breakout Trading Group | 2023 | Tampa, FL, USA | 1-10 | $1.96M | Jul 15, 2024 | $1.96M |

| Axle Automation | 2023 | San Francisco, CA, USA | 1-10 | $2.5M | Jul 29, 2024 | $2.5M |

| Linq.gg | 2023 | New York, NY, USA | 1-10 | $2.3M | Jun 27, 2024 | $3.8M |

| Nest Wallet | 2022 | San Francisco, CA, USA | 1-10 | $3.6M | Feb 20, 2024 | $3.6M |

1. Juicyway

- Founded: 2021

- Location: Wilmington, Delaware, USA

- Industry: Financial Services, FinTech, Payments

- Number of Employees: 11-50

- Total Funding Amount: $3M

- Last Funding Amount: $3M (Latest Round: Dec 16, 2024)

Juicyway is a financial technology company revolutionizing cross-border payments for businesses and individuals. Their cutting-edge payment network platform facilitates seamless international financial transactions, enabling enterprises to engage in global trade with ease.

Juicyway’s platform is designed to eliminate traditional barriers in international payments, such as high transaction fees, long processing times, and complex regulatory requirements. By leveraging advanced financial technology, Juicyway provides a secure, efficient, and cost-effective solution for businesses looking to expand their global reach.

2. Sandbox Wealth

- Founded: Feb 16, 2023

- Location: New York, USA

- Industry: Financial Services, FinTech, Software

- Number of Employees: 1-10

- Total Funding Amount: $1.25M

- Last Funding Amount: $1.25M (Latest Round: Dec 4, 2024)

Sandbox Wealth is a cutting-edge fintech company providing liquidity solutions for clients of independent advisors and family offices. Their platform integrates cash management, credit solutions, and predictive analytics to enhance the banking experience for sophisticated users.

By offering a seamless private banking experience tailored to non-bank financial institutions, Sandbox Wealth empowers advisors to strengthen relationships with their high-net-worth clients. Their technology-driven approach optimizes financial decision-making, ensuring clients have access to the best liquidity options available.

3. Billboxx

- Founded: Feb 15, 2023

- Location: New York, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $1.8M

- Last Funding Amount: $1.6M (Latest Round: Dec 11, 2024)

Billboxx is a fintech company dedicated to helping small businesses streamline their payment processes. By providing an intuitive platform for invoicing, bill payments, and cash flow management, Billboxx ensures that businesses can pay and get paid on time, reducing administrative burdens and enhancing financial stability.

With automation at its core, Billboxx eliminates manual payment hassles, allowing small business owners to focus on growth rather than financial logistics. The platform integrates with various accounting tools, enabling seamless transactions and better financial planning.

4. Cofactor AI

- Founded: Aug 2023

- Location: Chicago, Illinois, USA

- Industry: Financial Services, FinTech, Health Care

- Number of Employees: 1-10

- Total Funding Amount: $4M

- Last Funding Amount: $4M (Latest Round: Nov 25, 2024)

Cofactor AI is a financial intelligence platform designed specifically for the healthcare industry. It streamlines the complex process of managing insurance payer denials, helping hospitals and healthcare providers maximize revenue recovery.

By leveraging artificial intelligence, Cofactor AI automates the appeals process for denied claims, ensuring faster, more efficient responses to insurance disputes, retrospective reviews, and audits. The platform’s data-driven approach improves success rates in claim appeals, reduces administrative burdens, and accelerates cash flow for healthcare institutions.

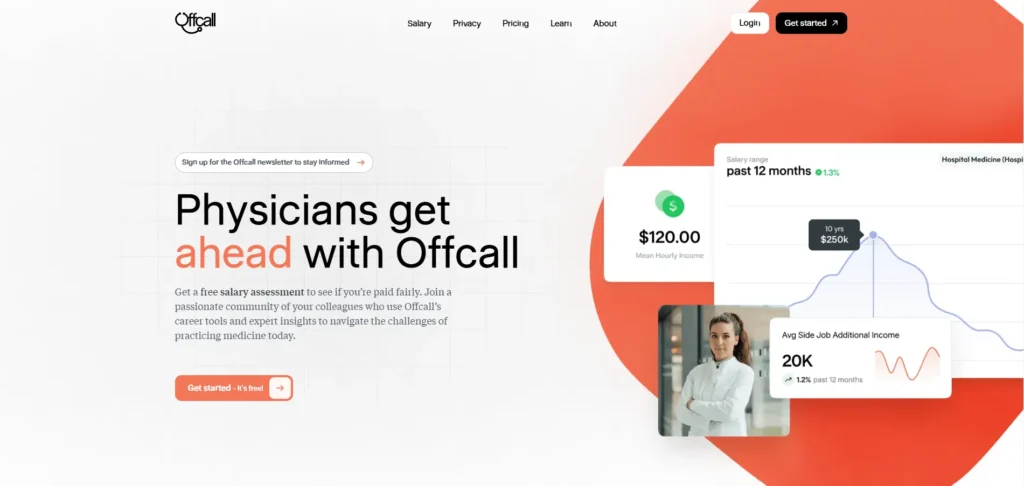

5. Offcall

- Founded: 2024

- Location: San Francisco, California, USA

- Industry: Financial Services, Health Care, Medical

- Number of Employees: 1-10

- Total Funding Amount: $2M

- Last Funding Amount: $2M (Latest Round: Dec 4, 2024)

Offcall is tackling physician burnout by offering transparency in salaries, work-life balance insights, and financial education tailored for healthcare professionals. The platform helps doctors navigate career decisions with clarity, providing critical data on compensation, work expectations, and financial planning.

In addition to offering salary benchmarks and financial wellness resources, Offcall integrates AI-powered analytics to help physicians compare job opportunities, optimize career paths, and maximize earnings without compromising their well-being. By addressing key stressors in the medical profession, Offcall aims to create a more sustainable and fulfilling work environment for healthcare providers.

6. Wasabi

- Founded: 2022

- Location: New York, New York, USA

- Industry: Financial Services, Software

- Number of Employees: 1-10

- Total Funding Amount: $3M

- Last Funding Amount: $3M (Latest Round: Jun 17, 2024)

Wasabi is a decentralized financial platform specializing in NFT trading. The company operates an innovative NFT options protocol, allowing traders to leverage blockchain-based securities, NFT tokens, and market analytics to execute strategic trades.

By providing a transparent and efficient decentralized trading ecosystem, Wasabi enables users to earn stable, low-risk income by collecting premiums and capitalizing on market volatility through NFT options trading. The platform is designed for both institutional and retail traders, offering a seamless experience in managing digital assets and optimizing trading strategies.

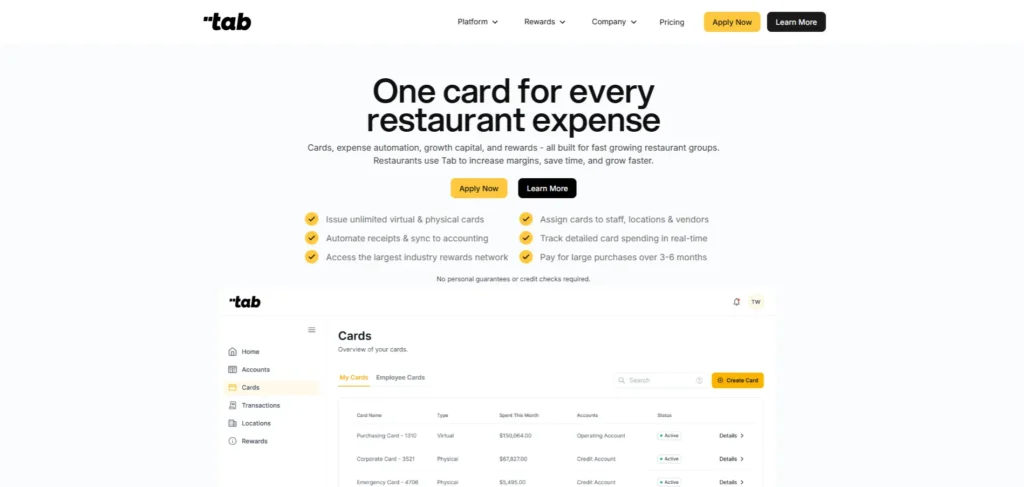

7. Tab Commerce

- Founded: 2021

- Location: Austin, Texas, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Total Funding Amount: $3.75M

- Last Funding Amount: $2.5M (Latest Round: Sep 9, 2024)

Tab Commerce is a fintech company dedicated to transforming financial management in the restaurant industry. Their flagship product, the Spend Control Platform, helps restaurant owners manage expenses, optimize profitability, and streamline financial operations.

The platform provides valuable insights into spending patterns, empowering restaurant owners and operators to make informed decisions that enhance financial health. Tab Commerce’s solutions allow restaurants to track and control expenditures, thus improving efficiency and supporting better financial decision-making.

8. AgentSmyth

- Founded: Mar 1, 2024

- Location: New York, New York, USA

- Industry: Financial Services, Stock Exchanges

- Number of Employees: 1-10

- Total Funding Amount: $2.5M

- Last Funding Amount: $2.5M (Latest Round: Apr 17, 2024)

AgentSmyth is pioneering the future of financial analysis with its innovative suite of autonomous AI agents. These smart agents act as specialized team members, automating financial research and analysis for leading financial institutions.

The company’s platform provides in-depth macro research, detailed insights at the ticker and sector levels, and real-time monitoring of unusual option flows, delivering tick-by-tick narratives that enhance decision-making processes.

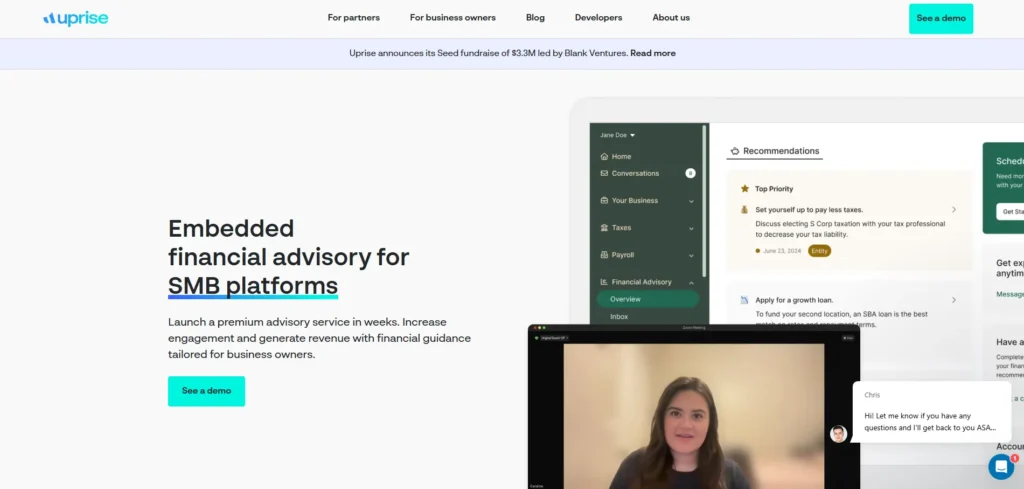

9. Uprise

- Founded: 2021

- Location: San Francisco, California, USA

- Industry: Financial Services, Personal Finance

- Number of Employees: 1-10

- Total Funding Amount: $4.7M

- Last Funding Amount: $3.3M (Latest Round: Oct 21, 2024)

Uprise is democratizing wealth management by making the tools and strategies of the financial elite accessible to everyone. Founded by Chris Goodmacher and Jessica Chen Riolfi, Uprise offers a platform designed to help individuals build wealth through expert guidance, personalized financial strategies, and education.

The company focuses on providing resources typically reserved for the wealthiest 1%, enabling a broader audience to optimize their financial portfolios and achieve long-term financial goals. Uprise’s mission is to level the playing field in personal finance, empowering individuals from all walks of life to manage their wealth efficiently and effectively.

10. Hapax

- Founded: 2024

- Location: Austin, Texas, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Total Funding Amount: $2.6M

- Last Funding Amount: $2.6M (Latest Round: Apr 3, 2024)

Hapax is a financial services platform designed to bridge the information access gap between large banks and smaller institutions. By leveraging advanced technology, Hapax aims to create a more inclusive financial ecosystem, providing tools and services that address the unique challenges faced by smaller financial entities.

Through its platform, Hapax offers superior technology solutions that empower smaller institutions to compete effectively with larger counterparts, thus fostering better financial services for both businesses and consumers alike. The company is focused on overcoming barriers to access and ensuring that all players in the financial industry have the resources they need to succeed.

11. RubyWell

- Founded: 2023

- Location: New York, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $1.11M

- Last Funding Amount: $1.11M (Latest Round: Oct 17, 2024)

RubyWell is an intelligent and automated financial guide designed to assist family caregivers in regaining financial stability. The platform continuously discovers and delivers new savings, benefits, and compensation opportunities tailored to the unique needs of family caregivers.

RubyWell aims to alleviate the financial stress that caregivers often face by providing them with valuable resources and insights to help them optimize their financial situation. The company is dedicated to empowering caregivers with the tools they need to improve their financial well-being while balancing their caregiving responsibilities.

12. Talli Digital Payments

- Founded: 2024

- Location: New York, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $4M

- Last Funding Amount: $4M (Latest Round: Nov 11, 2024)

Talli Digital Payments is a fintech company revolutionizing how payment services are offered to businesses and individuals. Specializing in digital payment solutions, Talli ensures smooth and secure financial transactions with cutting-edge technology. By automating complex processes, they reduce manual effort, increase transaction speed, and eliminate common barriers in payment processing.

Focused on providing accessible, scalable, and flexible payment services, Talli aims to make digital transactions easier and more reliable for enterprises of all sizes. Their platform is designed to empower businesses by integrating smart financial tools and ensuring that all users, whether large enterprises or small businesses, have access to cost-effective and secure payment options. As digital finance continues to evolve, Talli is positioning itself to be a key player in shaping the future of financial services.

13. FutureMoney

- Founded: Jan 6, 2023

- Location: Boston, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $2.5M

- Last Funding Amount: $2.5M (Latest Round: Oct 9, 2024)

FutureMoney is a financial services company designed to help parents and guardians build generational wealth for their children. The platform offers automated, tax-advantaged investing tools, primarily focusing on empowering families to invest in their children’s future with ease. By introducing the Junior Roth IRA, FutureMoney allows funds for minors to grow tax-free, providing a unique opportunity to establish a strong financial foundation early in life.

Their intuitive, parent-led platform simplifies the investment process, making it easier for families to save for college, long-term wealth, or other future needs. In addition to its wealth-building tools, FutureMoney’s approach provides users with access to tax-advantaged savings plans tailored to the unique needs of their children. Whether you’re a first-time investor or experienced, FutureMoney aims to make investing accessible and impactful for families across the nation.

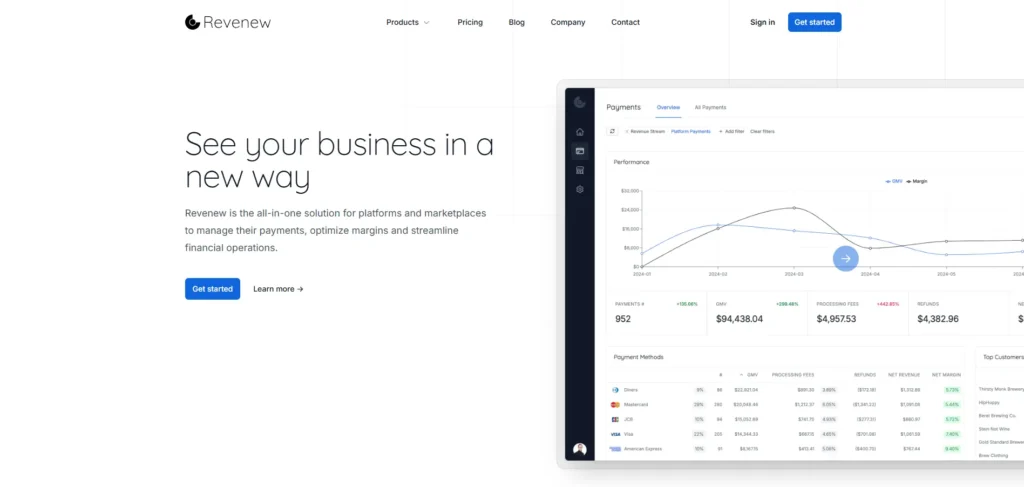

14. Revenew

- Founded: 2023

- Location: San Francisco, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $4.55M

- Last Funding Amount: $4.55M (Latest Round: Aug 22, 2024)

Revenew is a leading payment operation and optimization solution tailored for digital platforms and marketplaces. The company is committed to empowering platforms with the knowledge and resources they need to succeed in today’s digital economy.

Revenew simplifies the complexities of revenue optimization by providing a comprehensive platform that enables businesses to redefine success, streamline their payment operations, and achieve unprecedented growth. By focusing on improving payment processes, eliminating friction, and providing actionable insights, Revenew helps digital platforms unlock their full revenue potential.

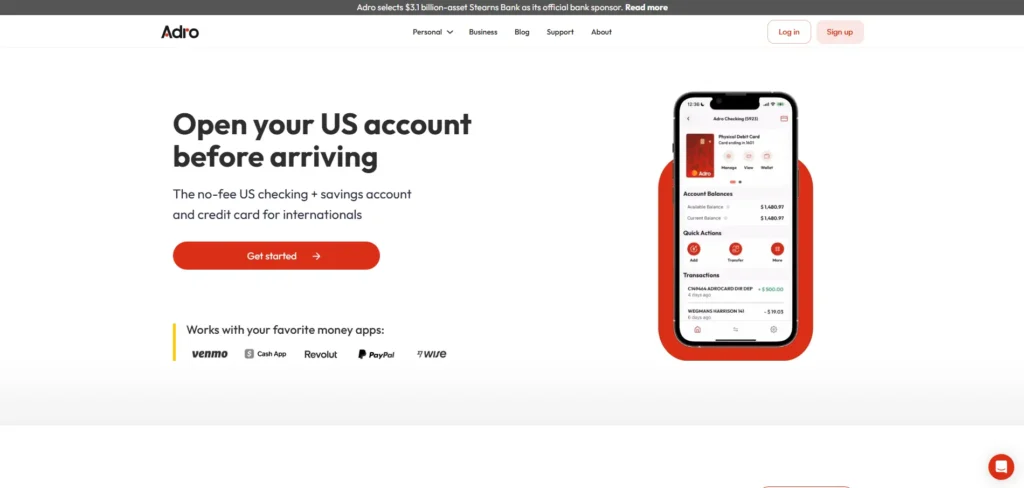

15. Adro

- Founded: Apr 25, 2023

- Location: New York, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $1.5M

- Last Funding Amount: $1.5M (Latest Round: Apr 9, 2024)

Adro serves as an onramp to essential financial services for international individuals moving to the United States for education or work. Designed to simplify the financial integration process for students and workers, Adro offers a wide range of services, such as equitable checking, savings, and credit accounts, all accessible from the moment of arrival—no SSN required.

In addition, Adro provides reduced rates on international money transfers and a streamlined tuition payment processing system, making it easier for users to manage their finances efficiently in a new country. The company’s goal is to eliminate the barriers to financial services that many international individuals face when starting fresh in the U.S., helping them thrive and integrate more seamlessly into their new environments.

16. Neptune

- Founded: 2024

- Location: New York, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $2.5M

- Last Funding Amount: $2.5M (Latest Round: Sep 19, 2024)

Neptune is transforming the traditionally transactional world of prenuptial agreements into meaningful conversations about the future. By leveraging AI-driven tools and expert guidance, Neptune helps couples navigate the prenup process with ease and alignment. Rather than focusing on legal battles, the platform encourages discussions about shared values and goals, creating a collaborative approach to financial planning for couples.

Neptune’s services make prenups more approachable, reducing the stress and stigma often associated with them. It aims to help couples create fair and balanced agreements that set them up for long-term success, ensuring both individuals feel confident and supported in their financial future together.

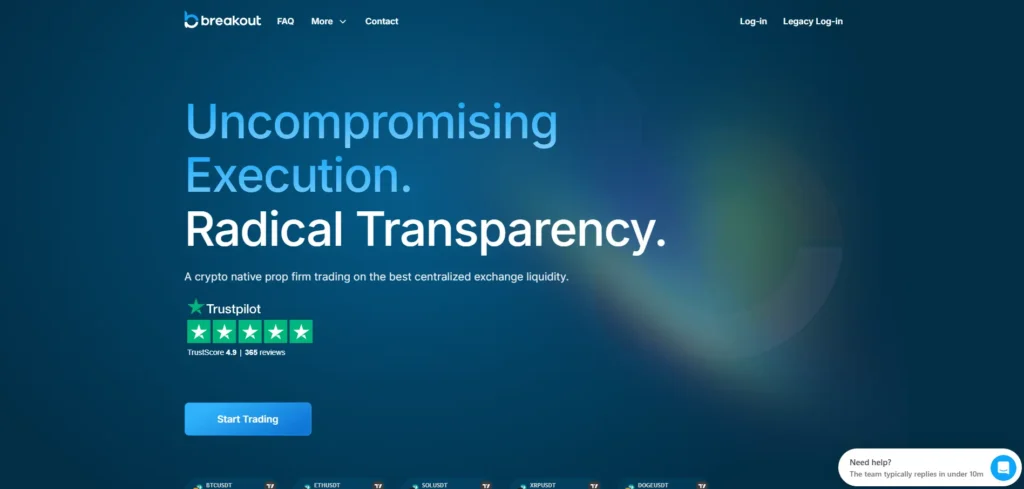

17. Breakout Trading Group

- Founded: 2023

- Location: Tampa, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $1.96M

- Last Funding Amount: $1.96M (Latest Round: Jul 15, 2024)

Breakout Trading Group is an evaluation-based proprietary trading firm that gives individuals the opportunity to trade on global markets and access real payouts. It is designed to provide aspiring traders with the chance to prove their skills and gain access to capital without the financial risk typically associated with starting out in trading.

The firm specializes in offering evaluations that test traders’ abilities, and once they meet the performance criteria, they can access live trading capital and profit-sharing opportunities. This model helps traders scale their trading careers while using the firm’s capital, rather than their own funds, to make trades.

18. Axle Automation

- Founded: 2023

- Location: San Francisco, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $2.5M

- Last Funding Amount: $2.5M (Latest Round: Jul 29, 2024)

Axle Automation offers a highly efficient solution for compliance operations teams, leveraging AI-driven automation to streamline complex workflows. With the help of Axle AI agents, organizations can reduce manual tasks, improve the accuracy of compliance-related processes, and save valuable time. These intelligent agents are designed to enhance productivity by automating repetitive tasks and ensuring that compliance procedures are executed consistently and reliably.

The company’s solution addresses the ever-increasing demand for operational efficiency in the financial services industry, providing a trustworthy, secure, and automated approach to compliance. By integrating Axle’s AI technology, companies can scale their compliance operations while maintaining a high level of accuracy and reliability, crucial for navigating the regulatory landscape.

19. Linq.gg

- Founded: Jan 2023

- Location: New York, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $3.8M

- Last Funding Amount: $2.3M (Latest Round: Jun 27, 2024)

Linq.gg provides a specialized fintech solution for mobile game developers, enabling them to create, publish, and scale real-money gaming experiences. By offering a platform tailored to the specific needs of the gaming industry, Linq.gg simplifies the development and monetization of mobile games that incorporate real-money transactions.

The company’s platform gives game developers the tools and resources to seamlessly integrate financial services into their games, providing players with a secure and exciting environment to play real-money games. With Linq.gg, developers can tap into the growing real-money gaming market and scale their operations while ensuring compliance and security standards.

20. Nest Wallet

- Founded: 2022

- Location: San Francisco, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Total Funding Amount: $3.6M

- Last Funding Amount: $3.6M (Latest Round: Feb 20, 2024)

Nest Wallet is a wallet specifically designed for traders, providing a seamless and integrated experience across mobile devices and browser extensions. This unique wallet allows traders to manage their assets efficiently by linking all wallets, offering quick and easy access to trading platforms and tools. With its user-friendly interface and focus on trading needs, Nest Wallet empowers traders with a secure and efficient solution for handling their crypto and digital assets, ensuring they can stay on top of their investments without hassle.

Conclusion

These 20 financial services startups, founded after 2020 and securing $1M to $5M in funding, are making waves by introducing innovative solutions to the financial sector. With fresh capital, they are revolutionizing areas such as digital banking, payments, wealth management, and lending, offering consumers more efficient, accessible, and user-friendly financial products. These companies are poised to reshape the future of finance and increase financial inclusion.

FAQs

Q. What trends are shaping financial services startups today?

Answer: Key trends include AI-powered financial solutions, digital payments, blockchain and cryptocurrency innovations, embedded finance, automation in wealth management, and personalized banking experiences.

Q. Are these startups publicly traded?

Answer: No, the startups listed are early-stage private companies that have secured funding from venture capitalists, angel investors, or other funding sources.

Q. What challenges do these startups face?

Answer: Some common challenges include regulatory compliance, competition from established financial institutions, customer acquisition, scalability, and securing further funding.