The financial services landscape is rapidly evolving, and a new wave of high-growth startups is reshaping the industry. These 15 financial services companies have recently secured $50M to $100M in funding, enabling them to scale innovative solutions in fintech, digital banking, and wealth management.

From AI-powered lending to blockchain-based payments and robo-advisory services, these startups are redefining the way consumers and businesses manage money.

Meet 15 Fast-Rising Financial Services Startups

Explore how these 15 startups are accelerating growth and driving innovation in the financial services industry.

Here are 15 financial services startups making a big impact!

| Company | Founded | Location | Employees | Last Funding | Last Funding Date | Total Funding |

|---|---|---|---|---|---|---|

| Strive Asset Management | 2022 | Columbus, OH, USA | 11-50 | $30M | Jul 23, 2024 | $50M |

| ATC Managers, LLC | 2021 | Bakersfield, CA, USA | 1-10 | $37M | Dec 23, 2024 | $51M |

| Outgo Inc | 2021 | Seattle, WA, USA | 11-50 | $50M | Sep 24, 2024 | $68.55M |

| Tradealgo | 2021 | New York, NY, USA | 51-100 | $9.35M | Oct 8, 2024 | $72.99M |

| Affiniti | 2021 | New York, NY, USA | 1-10 | $51M | Nov 13, 2024 | $62M |

| Wahed | 2015 | New York, NY, USA | 101-250 | Non Disclosure | Nov 23, 2024 | $90M |

| Wisetack | 2018 | San Francisco, CA, USA | 101-250 | $20.35M | Mar 20, 2024 | $84.35M |

| Alviere | 2017 | New York, NY, USA | 101-250 | Non Disclosure | May 28, 2024 | $70M |

| Obligo | 2017 | New York, NY, USA | 51-100 | $35M | Oct 21, 2024 | $92.5M |

| Citcon | 2016 | Santa Clara, CA, USA | 51-100 | $4.77M | Oct 3, 2024 | $52.77M |

| KPay | 2020 | Kwun Tong, Hong Kong | 501-1000 | $55M | Dec 3, 2024 | $65M |

| NomuPay | 2021 | Dublin, Ireland | 101-250 | $37M | Jan 7, 2025 | $90.6M |

| Cobre | 2020 | Bogotá, Colombia | 101-250 | $35M | Sep 5, 2024 | $66.2M |

| Finture | 2021 | Singapore, Singapore | 101-250 | $30M | Aug 19, 2024 | $77.5M |

| Midas | 2020 | Istanbul, Turkey | 101-250 | $45M | Apr 19, 2024 | $57M |

1. Strive Asset Management

- Founded: 2022

- Location: Columbus, Ohio, USA

- Industry: Financial Services

- Number of Employees: 11-50

- Last Funding Amount: $30M (Latest Round: July 23, 2024)

- Total Funding Amount: $50M

Strive Asset Management is an investment firm dedicated to restoring the voices of everyday citizens in the American economy. Unlike traditional asset managers who integrate political and social agendas into their investment strategies, Strive prioritizes shareholder value and corporate excellence. By advocating for a pro-merit approach, the firm encourages companies to focus on business performance rather than external political pressures.

Strive aims to reshape corporate governance and investment practices, ensuring that American businesses are led by market-driven principles. With a commitment to fiduciary responsibility, Strive provides investors with an alternative to ESG-focused investment firms, emphasizing financial returns over ideological influence.

2. ATC Managers, LLC

- Founded: 2021

- Location: Bakersfield, California, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Last Funding Amount: $37M (Latest Round: December 23, 2024)

- Total Funding Amount: $51M

ATC Managers, LLC is a nationwide direct private lender specializing in real estate investment financing. Since its inception in 2021, the firm has rapidly emerged as a leading provider of capital solutions, funding over $572 million in loans. Established in response to the financial disruptions caused by the COVID-19 lockdown, ATC Managers was founded to offer flexible and reliable lending solutions for real estate investors.

The company, led by founder Vanmatre Wilbur, provides customized loan structures for projects ranging from fix-and-flip properties to large-scale commercial developments. ATC Managers is committed to empowering real estate investors with capital access, ensuring they have the financial resources to seize market opportunities and grow their portfolios.

3. Outgo Inc

- Founded: March 3, 2021

- Location: Seattle, Washington, USA

- Industry: Financial Services, FinTech, Freight Service

- Number of Employees: 11-50

- Last Funding Amount: $50M (Latest Round: September 24, 2024)

- Total Funding Amount: $68.55M

Outgo Inc is a venture-backed financial technology company providing an all-in-one vertical banking solution for freight carriers. Designed to streamline financial operations, Outgo offers automated broker setups, invoicing, factoring, collections, accounting, and tax services—without contracts or minimums. By tackling a decades-long challenge in the freight industry, Outgo empowers carriers to take full control of their finances. Founded by former executives from top transportation companies such as Uber and Convoy, Outgo launched in 2022 and is headquartered in Seattle, Washington.

4. Tradealgo

- Founded: 2021

- Location: New York, New York, USA

- Industry: Financial Services, FinTech

- Number of Employees: 51-100

- Last Funding Amount: $9.35M (Latest Round: October 8, 2024)

- Total Funding Amount: $72.99M

Tradealgo is a financial technology company that provides real-time data and independent insights to empower everyday investors. By leveraging advanced analytics and market intelligence, Tradealgo offers investors the tools to make informed decisions, bridging the gap between institutional-grade data and retail traders. The company focuses on democratizing financial information, ensuring users have access to cutting-edge insights that were previously only available to large firms.

5. Affiniti

- Founded: 2021

- Location: New York, New York, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Last Funding Amount: $51M (Latest Round: November 13, 2024)

- Total Funding Amount: $62M

Affiniti is a financial services company focused on empowering small businesses across America with industry-tailored credit cards. By offering personalized and flexible financial solutions, Affiniti helps businesses optimize their financial operations, providing access to credit cards that are specifically designed to meet the unique needs of various industries. With a vision to fuel the growth of small businesses, Affiniti ensures that entrepreneurs have the financial support necessary to succeed and thrive.

6. Wahed

- Founded: 2015

- Location: New York, New York, USA

- Industry: Financial Services, FinTech

- Number of Employees: 101-250

- Last Funding Amount: Non-Disclosure (Latest Round: November 23, 2024)

- Total Funding Amount: $90M

Wahed is a financial services company offering ethical, Sharia-compliant investment solutions to individuals worldwide. Established with the goal of making investing accessible, Wahed provides an array of services, including personalized investment portfolios and automated investing options. The platform combines technology with responsible investment strategies, enabling clients to invest in line with their values while pursuing financial growth. Wahed’s mission is to create a more inclusive and sustainable financial ecosystem for everyone, regardless of experience.

7. Wisetack

- Founded: 2018

- Location: San Francisco, California, USA

- Industry: Financial Services, FinTech

- Number of Employees: 101-250

- Last Funding Amount: $20.35M (Latest Round: March 20, 2024)

- Total Funding Amount: $84.35M

Wisetack is a financial services platform that provides financing options for businesses and consumers. They specialize in offering point-of-sale financing, allowing customers to easily pay for services and products over time. Focused on streamlining the lending process, Wisetack partners with businesses across various industries to enable them to offer affordable, flexible payment plans. Their platform simplifies access to capital, enhancing customer experience and improving business outcomes. With a robust technological infrastructure, Wisetack is transforming the way businesses approach financing and driving consumer engagement.

8. Alviere

- Founded: 2017

- Location: New York, New York, USA

- Industry: Financial Services, FinTech

- Number of Employees: 101-250

- Last Funding Amount: Non-Disclosure (Latest Round: May 28, 2024)

- Total Funding Amount: $70M

Alviere is a leading provider of embedded financial services, empowering businesses to offer financial products to their customers. With a focus on simplifying complex financial services, Alviere’s platform enables companies to integrate banking solutions seamlessly into their offerings. Its services include banking, payments, and other financial products, all powered by cutting-edge technology and innovative approaches to financial inclusion. By democratizing access to finance, Alviere is shaping the future of the FinTech industry, making it easier for businesses of all sizes to provide financial solutions to their customers.

9. Obligo

- Founded: 2017

- Location: New York, New York, USA

- Industry: Financial Services, Information Technology

- Number of Employees: 51-100

- Last Funding Amount: $35M (Latest Round: October 21, 2024)

- Total Funding Amount: $92.5M

Obligo is transforming the rental industry by eliminating the need for traditional security deposits. With its innovative technology, Obligo allows tenants to avoid upfront security deposits while providing landlords with the assurance they need. By leveraging financial technology, Obligo creates a seamless and efficient process that benefits both tenants and property owners. The platform enables a more accessible rental experience, improving cash flow for tenants and enhancing financial security for landlords. Obligo’s commitment to providing smarter, more flexible solutions is redefining rental practices.

10. Citcon

- Founded: 2016

- Location: Santa Clara, California, USA

- Industry: Financial Services, FinTech

- Number of Employees: 51-100

- Last Funding Amount: $4.77M (Latest Round: October 3, 2024)

- Total Funding Amount: $52.77M

Citcon is a global payment platform designed to simplify cross-border transactions for merchants. The company provides a seamless payment experience for consumers and merchants alike by enabling easy integration of popular payment systems like Alipay, WeChat Pay, and UnionPay. By combining advanced payment solutions with a vast network of international payment providers, Citcon empowers businesses to accept payments from customers around the world, enhancing global commerce and customer satisfaction. Citcon’s innovative technology streamlines payment processes, making international transactions more efficient, secure, and accessible for businesses of all sizes.

11. KPay

- Founded: 2020

- Location: Kwun Tong, Kowloon, Hong Kong

- Industry: Financial Services, FinTech, Payments

- Number of Employees: 501-1000

- Last Funding Amount: $55M (Latest Round: December 3, 2024)

- Total Funding Amount: $65M

KPay is a leading financial services platform specializing in payment solutions for businesses in Asia. The company provides a range of services that enable businesses to accept payments seamlessly and securely across multiple channels. With a focus on innovation and efficiency, KPay offers a comprehensive suite of payment services, including mobile wallets, point-of-sale systems, and cross-border payment solutions. Their platform is designed to simplify the payment experience for both merchants and customers, with a commitment to enhancing financial inclusion and providing cutting-edge technology to meet the needs of modern businesses.

12. NomuPay

- Founded: 2021

- Location: Dublin, Ireland

- Industry: Financial Services, Information Technology, Payments

- Number of Employees: 101-250

- Last Funding Amount: $37M (Latest Round: January 7, 2025)

- Total Funding Amount: $90.6M

NomuPay is an innovative financial services provider that focuses on simplifying global payment solutions for businesses. Specializing in payments, NomuPay offers a range of integrated services that enable companies to process cross-border payments seamlessly. Their platform is designed to help businesses enhance financial efficiency and streamline transactions across multiple currencies and regions. NomuPay is committed to leveraging advanced technology to deliver scalable and secure payment services to businesses of all sizes, empowering them to operate in a fast-paced global marketplace.

13. Cobre

- Founded: May 14, 2020

- Location: Bogotá, Distrito Especial, Colombia

- Industry: Financial Services, FinTech

- Number of Employees: 101-250

- Last Funding Amount: $35M (Latest Round: September 5, 2024)

- Total Funding Amount: $66.2M

Cobre is a financial technology company based in Colombia that focuses on providing innovative financial solutions. Specializing in payment services, Cobre offers a range of tools that enhance financial management, making it easier for businesses to process payments and manage their finances. Their mission is to simplify the financial experience for companies in Latin America, helping them optimize their operations and access global payment infrastructure. With advanced technology, Cobre continues to expand its footprint in the region, empowering businesses to thrive in an increasingly connected world.

14. Finture

- Founded: November 1, 2021

- Location: Singapore, Central Region, Singapore

- Industry: Financial Services, FinTech

- Number of Employees: 101-250

- Last Funding Amount: $30M (Latest Round: August 19, 2024)

- Total Funding Amount: $77.5M

Finture is a financial technology company based in Singapore that offers innovative solutions in the financial services space. The company specializes in providing digital financial services that enhance the efficiency and accessibility of banking, investments, and personal finance management. With a focus on improving financial inclusion and empowering individuals and businesses, Finture leverages cutting-edge technology to simplify complex financial processes. The company continues to grow and expand its impact in the Southeast Asian market, providing tailored services that meet the unique needs of its customers.

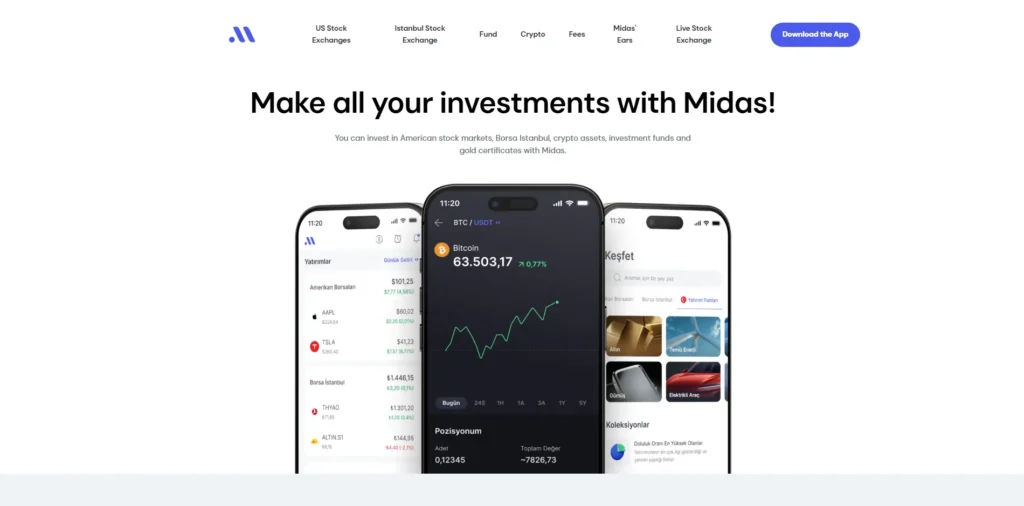

15. Midas

- Founded: February 27, 2020

- Location: Istanbul, Istanbul, Turkey

- Industry: Financial Services, Trading Platform

- Number of Employees: 101-250

- Last Funding Amount: $45M (Latest Round: April 19, 2024)

- Total Funding Amount: $57M

Midas is a financial services company based in Istanbul, Turkey, specializing in providing an innovative trading platform. The company aims to simplify and enhance the trading experience by offering an easy-to-use platform that supports various trading instruments. With a focus on both retail and professional traders, Midas offers tools and solutions designed to streamline the trading process, ensuring users have access to reliable market insights, real-time data, and effective risk management strategies. Midas is focused on expanding its user base and enhancing its platform to cater to the growing demand for secure and efficient online trading in Turkey and beyond.

Conclusion

The $50M-$100M investments in 15 high-growth financial services startups highlight the shift toward more accessible, efficient, and technology-driven financial solutions. These startups are transforming the financial landscape with innovations in digital banking, lending, payments, and financial planning. With these substantial investments, they are well-positioned to disrupt traditional financial systems, offering consumers smarter and more inclusive financial products.

FAQs

Q. What types of financial services do these startups focus on?

Answer: These startups focus on a wide range of financial services, including AI-powered financial platforms, decentralized finance (DeFi) solutions, next-gen payment systems, and digital banking solutions. Their innovations aim to disrupt traditional banking, payments, lending, investing, and more.

Q. How do AI and blockchain play a role in these innovations?

Answer: AI plays a key role in automating financial services, enhancing decision-making processes, and providing personalized financial insights. Blockchain enables transparency, security, and decentralization, particularly in solutions like DeFi, payments, and smart contracts, helping create more efficient and secure financial systems.

Q. What is the future outlook for these financial services startups?

Answer: The future looks promising for these startups as they continue to scale and innovate. With ongoing advancements in technology and increasing investment in the fintech space, these startups are poised to play a significant role in the transformation of the global financial services industry.