A new breed of financial services startups is rewriting the rules of money management, investing, and digital banking. Founded after 2020, these 10 trailblazing companies have each raised $100M+ in funding—proving that bold ideas in fintech still attract serious capital.

Whether it’s building next-gen payment systems, redefining lending platforms, or scaling embedded finance solutions, these startups are driving a financial revolution with speed and scale.

10 Fast-Rising Financial Services Companies Raising Over $100M

Discover the rising fintech giants transforming how businesses and consumers move, grow, and manage money.

| Company Name | Founded | Location | Number of Employees | Last Funding | Last Funding Date | Total Funding |

|---|---|---|---|---|---|---|

| Parafin | 2020 | San Francisco, CA | 101-250 | $100M | Dec 17, 2024 | $562M |

| One | 2022 | New York, NY | 251-500 | $300M | Dec 12, 2024 | $300M |

| Splitero | 2021 | San Diego, CA | 11-50 | $300M | Oct 17, 2024 | $317.5M |

| Imprint | 2020 | New York, NY | 51-100 | $75M | Oct 10, 2024 | $202M |

| Duetti | 2022 | New York, NY | 11-50 | $80M | Oct 29, 2024 | $243M |

| Pomelo | 2020 | San Francisco, CA | 51-100 | $75M | Apr 22, 2024 | $185M |

| Unlock | 2020 | New York, NY | 101-250 | $30M | Sep 3, 2024 | $430M |

| Efficient Capital Labs | 2022 | New York, NY | 1-10 | $11M | Aug 21, 2024 | $121.5M |

| Halfmore | 2023 | Palo Alto, CA | 1-10 | ₩1.5B | Mar 26, 2024 | ₩1.5B |

| Slide Insurance | 2021 | Tampa, FL | 101-250 | $175M | Jun 27, 2024 | $520M |

1. Parafin

- Founded: 2020

- Location: San Francisco, California, USA

- Industry: Finance, Financial Services, FinTech

- Number of Employees: 101-250

- Last Funding Amount: $100M (Latest Round: Dec 17, 2024)

- Total Funding Amount: $562M

Parafin is a financial infrastructure company that enables platforms to offer embedded financial products to small businesses. By simplifying capital markets, underwriting, servicing, compliance, and customer support, Parafin allows businesses to access financial services seamlessly. The company partners with major platforms like Amazon, Walmart, DoorDash, and TikTok to provide funding solutions, having extended offers of over $8 billion.

Parafin’s technology helps small businesses manage their financial needs without the complexity of traditional banking systems. Its innovative approach empowers entrepreneurs to thrive even in uncertain economic conditions, driving growth and stability across various industries.

2. One

- Founded: 2022

- Location: New York, New York, USA

- Industry: Finance, Financial Services, Mobile Apps

- Number of Employees: 251-500

- Last Funding Amount: $300M (Latest Round: Dec 12, 2024)

- Total Funding Amount: $300M

One is a comprehensive financial mobile app that delivers a wide range of banking and fintech solutions. With services including online payments, cash transactions, digital wallets, and money management tools, it aims to provide a seamless and efficient experience for its users. The app simplifies financial services by integrating them into one platform, making it easy for individuals to manage their money and financial needs. Backed by a robust technological infrastructure, One enables users to conduct secure transactions and access financial services effortlessly. The company’s goal is to redefine personal banking by offering innovative solutions for today’s digital economy.

3. Splitero

- Founded: 2021

- Location: San Diego, California, USA

- Industry: Finance, Financial Services, Payments

- Number of Employees: 11-50

- Last Funding Amount: $300M (Latest Round: Oct 17, 2024)

- Total Funding Amount: $317.5M

Splitero is a financial services company that enables homeowners to access their home equity without taking on new debt or additional monthly payments. It provides a unique solution for homeowners looking to unlock their property’s value while avoiding the traditional constraints of loans or mortgages. With a focus on flexibility and accessibility, Splitero offers financial products that help homeowners navigate their equity without the burden of extra monthly obligations.

The company’s innovative approach to home equity gives homeowners greater control and financial freedom, offering an alternative to conventional financing methods. Splitero continues to grow rapidly and is reshaping how people think about using home equity for their financial needs.

4. Imprint

- Founded: 2020

- Location: New York, New York, USA

- Industry: Finance, Financial Services, FinTech

- Number of Employees: 51-100

- Last Funding Amount: $75M (Latest Round: Oct 10, 2024)

- Total Funding Amount: $202M

Imprint specializes in co-branded credit cards, offering a modern payment platform that enhances user experience and provides tailored rewards. The company partners with global consumer brands to create loyalty credit cards that offer unique, personalized rewards based on users’ preferences. Imprint’s digital cardholder experience and custom-designed technology stack allow for a fully integrated and customized credit card program for each partner brand.

By focusing on seamless integrations, Imprint aims to redefine the co-branded credit card space, helping brands build stronger customer loyalty and providing cardholders with value-driven rewards. Through its innovative approach, Imprint continues to expand its influence in the financial services and fintech sectors.

5. Duetti

- Founded: 2022

- Location: New York, New York, USA

- Industry: Financial Services, FinTech, Music

- Number of Employees: 11-50

- Last Funding Amount: $80M (Latest Round: Oct 29, 2024)

- Total Funding Amount: $243M

Duetti is a music fintech company that provides financial solutions to independent musicians by purchasing their catalog rights and monetizing them through data-driven marketing and social media. By offering artists quick access to catalog sales, Duetti unlocks new investment opportunities and creates innovative revenue streams. It also provides accurate, data-driven pricing for established tracks, enabling musicians to sell individual songs or even portions of their catalogs.

By utilizing ROI-focused marketing techniques, Duetti helps artists maximize the value of their work and gain financial independence. The company’s approach aims to disrupt the traditional music industry, offering more freedom and opportunities for independent musicians.

6. Pomelo

- Founded: 2020

- Location: San Francisco, California, USA

- Industry: Financial Services, FinTech

- Number of Employees: 51-100

- Last Funding Amount: $75M (Latest Round: Apr 22, 2024)

- Total Funding Amount: $185M

Pomelo is a financial technology platform that integrates credit and international money transfer services, focusing on providing immigrants with an affordable way to share funds with their loved ones abroad. The company’s mission is to empower families to connect and thrive across borders, offering low-cost financial services that bridge international gaps.

Founded by experienced operators and backed by prominent investors such as Keith Rabois of Founders Fund, Kevin Hartz (Co-founder/CEO of Xoom), and celebrities like The Chainsmokers and The Weeknd, Pomelo aims to disrupt the financial landscape by combining consumer credit and international money movement into one seamless experience. The company is committed to promoting financial empowerment and global connectivity.

7. Unlock

- Founded: 2020

- Location: New York, New York, USA

- Industry: Finance, Financial Services, Real Estate

- Number of Employees: 101-250

- Last Funding Amount: $30M (Latest Round: Sep 3, 2024)

- Total Funding Amount: $430M

Unlock Technologies offers innovative financial solutions that allow homeowners to access the equity in their homes without taking out traditional loans or mortgages. Through their Home Equity Agreements (HEAs), Unlock provides homeowners with cash in exchange for a share of the future value of their home. Unlike traditional home equity loans, there are no monthly payments or interest charges, and the agreement is settled when the homeowner sells their home or at the end of the agreement’s term.

The company’s model provides homeowners with an alternative to traditional borrowing methods, giving them flexibility while maintaining ownership. Unlock Technologies is focused on transforming home equity into a valuable asset for homeowners seeking to unlock the potential of their property without the complexities of conventional financing.

8. Efficient Capital Labs

- Founded: 2022

- Location: New York, New York, USA

- Industry: Financial Services, FinTech, SaaS

- Number of Employees: 1-10

- Last Funding Amount: $11M (Latest Round: Aug 21, 2024)

- Total Funding Amount: $121.5M

Efficient Capital Labs is transforming the venture capital landscape by providing fast, seamless, and cost-effective capital solutions to B2B SaaS businesses. Specializing in companies that have a significant product and operations presence in India while generating revenues from the US and other top markets, Efficient Capital Labs offers non-dilutive funding to support growth without giving up equity.

The firm’s approach is to empower SaaS businesses with the capital they need to scale quickly and efficiently, helping them unlock their potential and compete in global markets. With a focus on innovation and operational efficiency, Efficient Capital Labs is redefining how SaaS companies access the financial resources necessary for expansion.

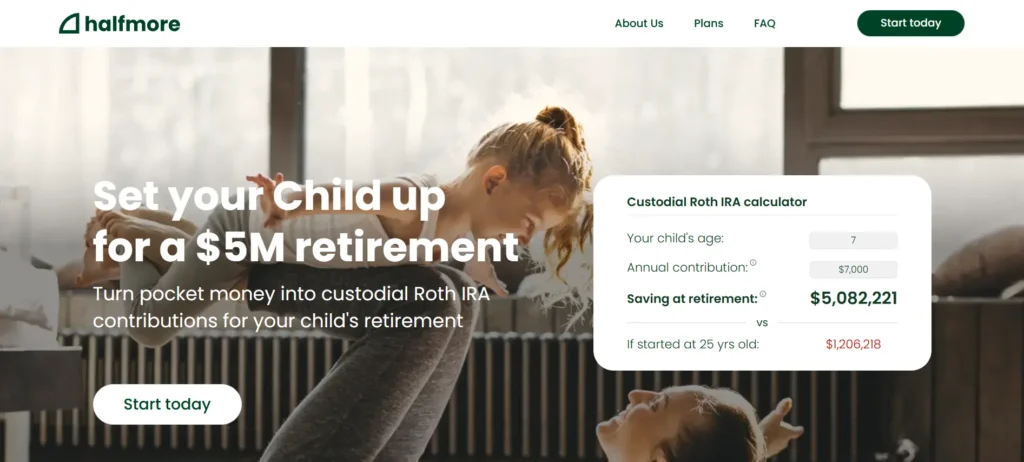

9. Halfmore

- Founded: 2023

- Location: Palo Alto, California, USA

- Industry: Financial Services, Information Technology

- Number of Employees: 1-10

- Last Funding Amount: ₩1.5B (Latest Round: Mar 26, 2024)

- Total Funding Amount: ₩1.5B

Halfmore is a fintech platform dedicated to helping parents build generational wealth for their children. Founded by alumni from prestigious institutions like Stanford, Yale Law, and Teach For America, Halfmore brings financial strategies traditionally reserved for the wealthy to families across America, empowering them to create a better future for the next generation.

The platform leverages innovative wealth-building strategies to allow parents to invest in their children’s financial future, setting them on a path toward long-term success and security. With a focus on financial inclusion, Halfmore aims to make generational wealth accessible to every family, providing the tools needed to achieve financial independence.

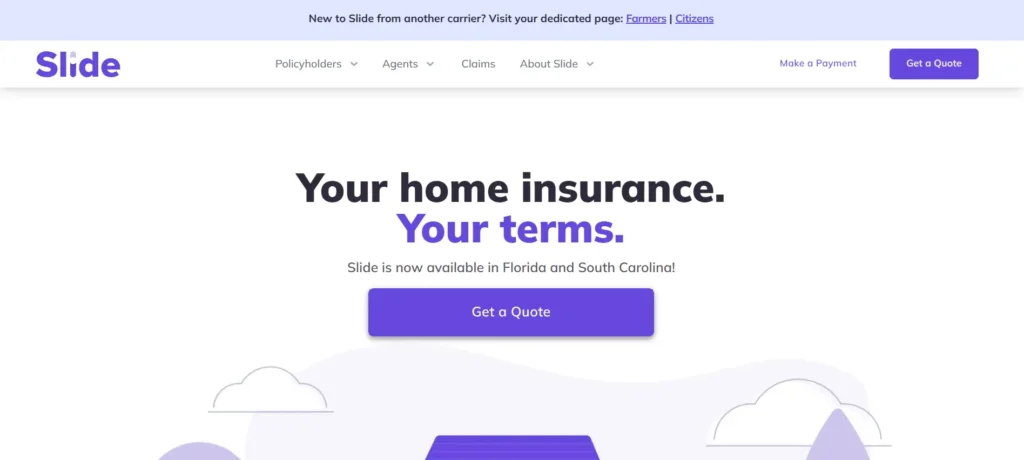

10. Slide Insurance

- Founded: 2021

- Location: Tampa, Florida, USA

- Industry: Financial Services, Insurance

- Number of Employees: 101-250

- Last Funding Amount: $175M (Latest Round: Jun 27, 2024)

- Total Funding Amount: $520M

Slide Insurance is a technology-enabled insurance provider that uses cutting-edge technology, artificial intelligence, and big data to offer homeowners personalized, flexible, and seamless home insurance coverage. By leveraging advanced data-driven underwriting, Slide’s platform ensures high-performance outcomes, improving the customer experience and delivering tailored insurance solutions.

The company’s innovative approach to home insurance empowers consumers with more control over their policies, making the process simpler, faster, and more efficient. Slide is transforming the home insurance industry by focusing on AI-powered solutions to create more accessible and personalized coverage for homeowners across the nation.

Conclusion

The financial services landscape is being redefined by a new generation of startups founded after 2020—each securing over $100M in funding. These innovative companies are streamlining everything from digital banking and payments to credit infrastructure and embedded finance. Their rapid success reflects a global demand for faster, smarter, and more inclusive financial solutions. Backed by bold investors, they are scaling quickly and poised to lead the fintech revolution into the next decade.

FAQs

Q. What types of services does One offer to its users?

Answer: One is a comprehensive mobile app that provides a range of financial services, including online payments, cash transactions, digital wallets, and money management tools. It aims to simplify personal banking by offering everything users need in one platform.

Q. What role does AI play in Slide Insurance’s services?

Answer: Slide Insurance uses artificial intelligence and big data to offer personalized and flexible home insurance solutions. AI-driven underwriting allows for more efficient and tailored coverage, making the process faster and more customer-friendly.

Q. How does Efficient Capital Labs support B2B SaaS businesses?

Answer: Efficient Capital Labs provides non-dilutive funding to B2B SaaS companies, particularly those with a strong presence in India and generating revenue from the US. This allows businesses to scale quickly without giving up equity, a crucial factor for companies looking to grow while maintaining control.