The financial services sector is being reshaped by innovative startups securing crucial investments. These 15 companies have recently raised $5M to $10M to scale their fintech solutions, digital banking, and payment platforms.

From AI-powered lending to blockchain-based solutions and neobanks, these companies are driving the future of finance with cutting-edge technology and customer-first models.

Meet 15 Rising Financial Services Companies Backed by $5M–$10M

Discover how these financial services companies are shaping the next wave of innovation in the financial sector.

| Company | Founded | Location | Number of Employees | Last Funding | Last Funding Date | Total Funding |

|---|---|---|---|---|---|---|

| StretchDollar | 2023 | San Francisco, CA, USA | 1-10 | $6M | December 3, 2024 | $7.6M |

| Plenty | 2022 | San Francisco, CA, USA | 1-10 | $5M | May 9, 2024 | $7.75M |

| Truflation | 2021 | San Francisco, CA, USA | 11-50 | Non-Disclosure | March 28, 2024 | $6M |

| Mesa | 2023 | Austin, TX, USA | 11-50 | $7.2M | September 24, 2024 | $9.2M |

| Powder | 2023 | Los Altos, CA, USA | 1-10 | $5M | July 23, 2024 | $5.5M |

| When Insurance | 2020 | Highwood, IL, USA | 11-50 | $4.6M | August 1, 2024 | $7.08M |

| TakeProfit | 2021 | San Francisco, CA, USA | 11-50 | $6.71M | November 25, 2024 | $9.71M |

| AnchorZero | 2021 | Hoboken, NJ, USA | 11-50 | $8M | June 25, 2024 | $8M |

| Kinto | 2023 | Orlando, FL, USA | 1-10 | $5M | July 9, 2024 | $10M |

| Cadana | 2021 | New York, NY, USA | 11-50 | $7.1M | June 20, 2024 | $7.1M |

| B Generous | 2021 | Los Angeles, USA | 11-50 | Non-Disclosure | August 1, 2024 | $10M |

| Grazzy | 2021 | Austin, USA | 11-50 | $4M | July 25, 2024 | $8.25M |

| Brico | 2023 | San Francisco, USA | 1-10 | $8M | September 11, 2024 | $8M |

| Kappa Pay | 2021 | Boston, USA | 1-10 | $5M | April 8, 2024 | $8.6M |

| IncumbentFI | 2022 | San Francisco, USA | 11-50 | $5.64M | October 10, 2024 | $5.64M |

1. StretchDollar

- Founded: 2023

- Location: San Francisco, California, USA

- Industry: Financial Services, Health Insurance

- Number of Employees: 1-10

- Last Funding Amount: $6M (Latest Round: Dec 3, 2024)

- Total Funding Amount: $7.6M

StretchDollar is an innovative insurance company that provides customized health benefits for small businesses. The platform allows employers to offer their employees the flexibility to choose the health plan that best suits their needs. By leveraging pre-tax dollars, StretchDollar enables employees to shop for plans, making health insurance more accessible and affordable for small businesses and their workforce.

With its user-friendly platform, StretchDollar simplifies the process of providing health insurance benefits, giving businesses the tools to manage their offerings effectively. This ensures that small businesses can remain competitive by providing robust healthcare options, even with limited resources.

2. Plenty

- Founded: 2022

- Location: San Francisco, California, USA

- Industry: Financial Services, FinTech, Funding Platform

- Number of Employees: 1-10

- Last Funding Amount: $5M (Latest Round: May 9, 2024)

- Total Funding Amount: $7.75M

Plenty is a financial planning application designed to help users achieve financial independence more quickly. By providing individualized insights at affordable prices, the company enables consumers to access a personalized financial planning platform to manage their wealth. The platform helps users navigate their financial journey, whether they are focused on saving, investing, or planning for the future.

Plenty’s mission is to make financial freedom attainable by delivering easy-to-understand, data-driven financial advice tailored to each user’s unique goals. With its intuitive tools and resources, Plenty empowers users to make informed decisions that accelerate their path to financial independence.

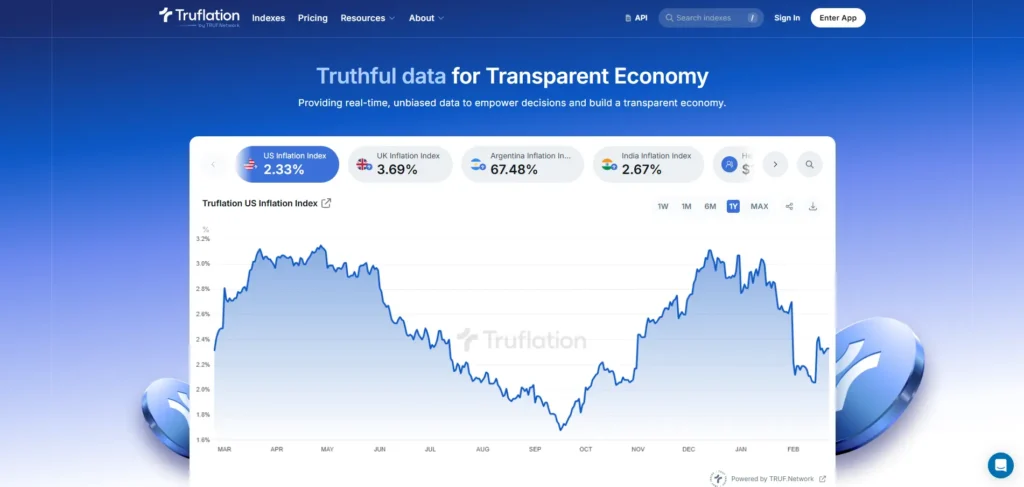

3. Truflation

- Founded: July 2021

- Location: San Francisco, California, USA

- Industry: Financial Services, Information Technology

- Number of Employees: 11-50

- Last Funding Amount: Non Disclosure (Latest Round: Mar 28, 2024)

- Total Funding Amount: $6M

Truflation is an innovative data hub that provides independent, real-time economic data and price indexes for both fiat and crypto markets. By aggregating real-market prices from various sources, such as merchants, research institutions, and commercial data providers, Truflation calculates the most accurate and up-to-date daily inflation rates. This data is crucial for understanding economic conditions and provides users with reliable inflation information that can drive decision-making in the financial sector.

In addition to inflation data, Truflation also offers indices related to emerging digital assets like NFTs. These indices are made available on-chain, making them accessible for decentralized finance (DeFi) and Web3 applications. Truflation’s commitment to delivering unbiased, data-driven insights helps bridge the gap between traditional economic indicators and the evolving decentralized financial ecosystem.

4. Mesa

- Founded: 2023

- Location: Austin, Texas, USA

- Industry: Financial Services, Home Services

- Number of Employees: 11-50

- Last Funding Amount: $7.2M (Latest Round: Sep 24, 2024)

- Total Funding Amount: $9.2M

Mesa is a forward-thinking company dedicated to making homeownership more affordable and rewarding. By leveraging innovative financial solutions, Mesa provides unique services aimed at reducing the financial barriers that homeowners face. The company focuses on making homeownership more accessible, not only through financial services but also by ensuring a more seamless and rewarding experience for homeowners.

Mesa’s services aim to simplify homeownership, offering a combination of financial tools, home services, and value-driven solutions to help customers build long-term wealth through property. Mesa envisions a future where more individuals can enjoy the benefits of homeownership without the stress and complexities often associated with it.

5. Powder

- Founded: Jan 1, 2023

- Location: Los Altos, California, USA

- Industry: Financial Services, FinTech

- Number of Employees: 1-10

- Last Funding Amount: $5M (Latest Round: Jul 23, 2024)

- Total Funding Amount: $5.5M

Powder is a cutting-edge company specializing in generative AI agents designed to automate time-consuming tasks for wealth management firms. With a focus on enhancing operational efficiency, Powder’s AI-powered tools enable firms to save time on manual processes, ultimately allowing them to dedicate more resources toward serving clients and improving customer experiences.

Powder’s solutions target wealth management professionals, optimizing workflows and driving innovation in the financial services sector. By leveraging generative AI, Powder aims to revolutionize how financial firms manage tasks, streamlining operations and enhancing productivity across the industry.

6. When Insurance

- Founded: 2020

- Location: Highwood, Illinois, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $4.6M (Latest Round: Aug 1, 2024)

- Total Funding Amount: $7.08M

When Insurance is an AI-driven off-boarding platform that simplifies the health insurance process for employees transitioning between jobs. This personalized health insurance marketplace helps employees find health insurance alternatives, offering an easier and more affordable way to navigate the often-complex transition period after leaving a job.

Designed as a B2B solution, When Insurance partners with employers to enhance the off-boarding experience, reducing the risk of high claims by providing employees with viable alternatives to COBRA. The platform improves healthcare severance solutions, benefiting both employees and employers by offering seamless, accessible coverage options during job transitions.

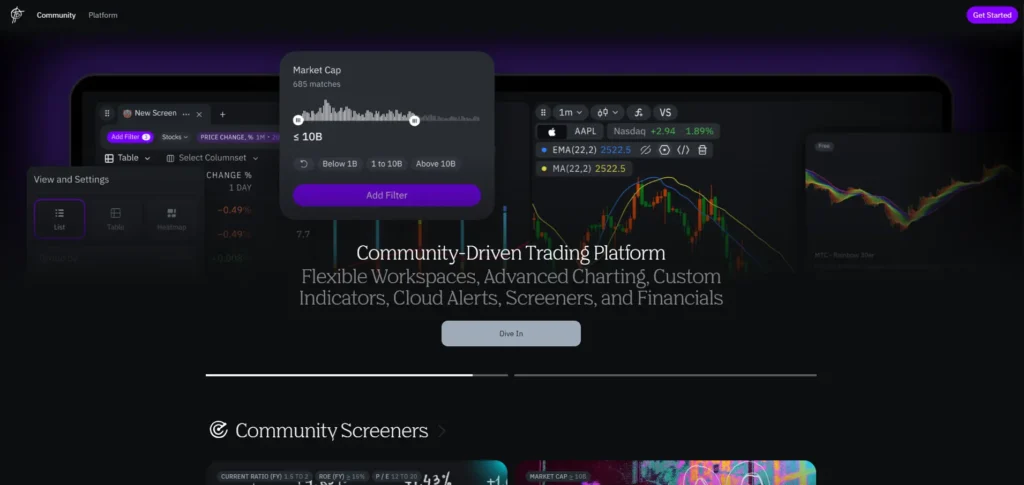

7. TakeProfit

- Founded: May 2021

- Location: San Francisco, California, USA

- Industry: Financial Services, Information Technology

- Number of Employees: 11-50

- Last Funding Amount: $6.71M (Latest Round: Nov 25, 2024)

- Total Funding Amount: $9.71M

TakeProfit is a community-driven trading platform designed to significantly reduce the time self-directed traders and investors spend on market analysis by over 50%. By using a cutting-edge tech stack (including WebGL and WASM), TakeProfit empowers users to outperform institutional investors with a smoother, more efficient, and intuitive trading experience. Even in its early beta phase, the platform has gained influential trader advocates due to its innovative approach and seamless user interface.

TakeProfit’s mission is to democratize trading by providing tools and resources that help traders at all levels optimize their strategies and maximize returns. It aims to level the playing field by offering advanced analysis features traditionally reserved for large institutions. The platform continuously evolves with community input, fostering a collaborative environment where traders can share insights, techniques, and strategies.

8. AnchorZero

- Founded: 2021

- Location: Hoboken, New Jersey, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $8M (Latest Round: Jun 25, 2024)

- Total Funding Amount: $8M

AnchorZero is a financial services platform designed to help entrepreneurs maximize tax breaks and achieve financial success by leveraging Roth IRAs. The company specializes in providing entrepreneurs with the tools and knowledge to use Roth IRAs strategically, enabling them to build wealth in a tax-efficient manner.

AnchorZero offers innovative solutions to help self-employed individuals and business owners benefit from Roth IRA tax advantages. By simplifying the process of opening, managing, and maximizing Roth IRAs, the platform empowers entrepreneurs to take control of their financial future and reduce tax burdens.

9. Kinto

- Founded: 2023

- Location: Orlando, Florida, USA

- Industry: Financial Services, Software

- Number of Employees: 1-10

- Last Funding Amount: $5M (Latest Round: Jul 9, 2024)

- Total Funding Amount: $10M

Kinto is a cutting-edge financial technology platform that functions as a KYC’ed (Know Your Customer) Layer 2, capable of supporting both modern financial institutions and decentralized protocols. Kinto bridges the gap between traditional finance and decentralized finance (DeFi), providing a secure, scalable, and user-friendly infrastructure for the integration of financial services with blockchain technology.

The platform aims to streamline the complex processes of financial regulation and compliance, making it easier for financial institutions and decentralized protocols to work together. By focusing on KYC compliance, Kinto ensures that both regulated financial entities and decentralized applications can operate securely and seamlessly within a regulated environment.

10. Cadana

- Founded: 2021

- Location: New York, New York, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $7.1M (Latest Round: Jun 20, 2024)

- Total Funding Amount: $7.1M

Cadana is a FinTech platform revolutionizing global hiring and payment processes. The company is on a mission to dismantle barriers to talent access worldwide. By providing a secure and compliant platform, Cadana enables companies to hire and pay employees in over 100 countries, ensuring that businesses can expand internationally while adhering to local laws and regulations.

Cadana’s solutions simplify cross-border payroll and compliance, making it easier for companies to manage remote teams globally without the complexities of navigating different payroll systems or regulatory requirements. This platform is a game-changer for businesses seeking to tap into a global talent pool with ease.

11. B Generous

- Founded: January 2021

- Location: Los Angeles, USA

- Industry: Financial Services

- Number of Employees: 11-50

- Last Funding Amount: Non-Disclosure (Latest Round: Aug 1, 2024)

- Total Funding Amount: $10M

B Generous is a platform focused on empowering individuals and businesses by facilitating charitable giving through a streamlined and collaborative approach. The company integrates giving and philanthropy into financial services by allowing people to contribute to charitable causes in an easy and efficient manner. B Generous aims to make generosity a seamless experience through its platform, leveraging technology to simplify donations and charitable engagements.

It offers innovative solutions that reduce the friction often associated with giving, encouraging more people to contribute to meaningful causes. Through a blend of financial services and social good, B Generous is creating a space where helping others becomes an easy, impactful part of daily life.

12. Grazzy

- Founded: 2021

- Location: Austin, USA

- Industry: Financial Services

- Number of Employees: 11-50

- Last Funding Amount: $4M (Latest Round: Jul 25, 2024)

- Total Funding Amount: $8.25M

Grazzy is revolutionizing the financial services sector by offering a modern, user-friendly platform designed to simplify the management of employee benefits and rewards. The company focuses on helping businesses provide seamless financial solutions to their employees, making the process of managing wages and benefits more efficient and streamlined. Grazzy’s goal is to create an intuitive system where businesses and employees can interact with financial services effortlessly, optimizing workflow and engagement.

The platform provides innovative solutions that help manage payments, benefits, and financial wellness offerings, empowering employees with better access to their earnings and rewards. Through its solution, Grazzy is contributing to transforming workplace financial wellness and offering a better, smarter alternative for businesses to manage their employee’ financial interactions.

13. Brico

- Founded: 2023

- Location: San Francisco, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Last Funding Amount: $8M (Latest Round: Sep 11, 2024)

- Total Funding Amount: $8M

Brico is an innovative AI-driven financial technology company focused on revolutionizing the financial services industry. The company leverages advanced artificial intelligence and machine learning technologies to provide enhanced solutions for managing financial services in a seamless, efficient manner. Brico is committed to simplifying financial operations, improving decision-making, and offering unique, data-driven insights to businesses and individuals alike.

Their platform offers tailored solutions that make complex financial processes more accessible, optimizing client engagement and financial planning. By providing cutting-edge AI capabilities, Brico empowers businesses to make smarter financial decisions with real-time data and insights.

14. Kappa Pay

- Founded: Aug 30, 2021

- Location: Boston, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Last Funding Amount: $5M (Latest Round: Apr 8, 2024)

- Total Funding Amount: $8.6M

Kappa Pay is a leading financial technology company providing innovative payment solutions for businesses. Its mission is to streamline financial transactions and payment processing for businesses of all sizes, ensuring seamless operations. By integrating advanced technologies into the payment ecosystem, Kappa Pay offers services that improve the efficiency and security of financial transfers.

Their platform supports a variety of digital payment systems, making it easier for companies to manage transactions and reduce friction in financial operations. With a focus on providing reliable, scalable solutions, Kappa Pay is revolutionizing the way businesses approach payment solutions.

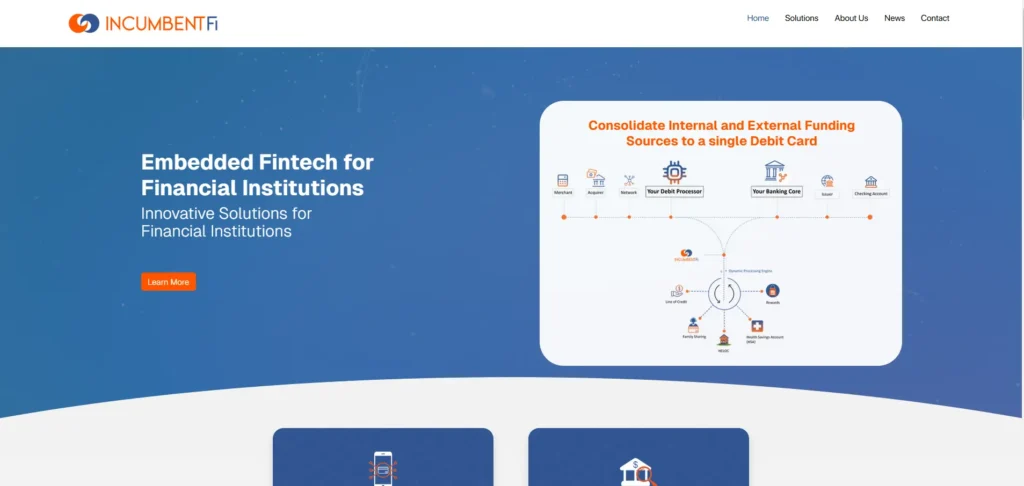

15. IncumbentFI

- Founded: 2022

- Location: San Francisco, USA

- Industry: Financial Services

- Number of Employees: 11-50

- Last Funding Amount: $5.64M (Latest Round: Oct 10, 2024)

- Total Funding Amount: $5.64M

IncumbentFI is a financial services company focused on providing innovative solutions to incumbent businesses. Specializing in modernizing and streamlining financial operations, IncumbentFI aims to empower businesses by improving access to financial tools, enabling easier integration with new technologies, and offering advanced data solutions.

Their platform is designed to help firms optimize and secure their financial workflows, making it easier for them to scale and innovate in a competitive landscape.

Conclusion

These 15 financial services companies, securing $5M–$10M in recent funding, are reshaping finance with innovative solutions in banking, lending, and insurance. Their fresh capital positions them to offer more accessible, efficient, and user-friendly financial services, making an impact on both consumers and businesses.

FAQs

Q. What is the focus of the financial services companies highlighted in this blog?

Answer: The companies in this blog focus on leveraging innovative technologies such as fintech, blockchain, AI, and data analytics to disrupt traditional financial models. They are redefining areas such as banking, payments, investment management, and personal finance.

Q. Are these companies disrupting the traditional banking system?

Answer: Yes, many of these companies are offering alternative solutions to traditional banking. They are changing how individuals manage their finances, invest, make payments, and even handle digital assets. Their approach makes financial services more accessible, faster, and more secure.

Q. Can these startups be trusted with my financial data?

Answer: Most of these companies prioritize security and compliance with financial regulations to ensure the safety of your data. However, it’s always a good idea to do your own research before using any new financial service. Checking for certifications, reviews, and customer feedback can help you make an informed decision.