A new era of financial innovation is here, and it’s being shaped by bold, agile startups with big ideas. These 20 companies have secured between $10M and $50M in funding to reimagine payments, lending, wealth management, and digital banking.

With tech-driven platforms, smart automation, and customer-first models, these innovators are challenging traditional finance and setting new standards for the industry.

20 High-Growth Financial Startups You Need to Know

Discover the financial startups transforming how people and businesses manage money in the digital age.

Let’s take a closer look at 20 financial services startups making waves with their recent funding and industry impact!

| Company | Founded | Location | Employees | Last Funding | Last Funding Date | Total Funding |

|---|---|---|---|---|---|---|

| Infinant | 2021 | Charlotte, NC, USA | 11-50 | $15M | Dec 23, 2024 | $20M |

| RLTYco | 2021 | New York, NY, USA | 11-50 | $20M | Jan 9, 2025 | $20M |

| Strive Asset Management | 2022 | Columbus, OH, USA | 11-50 | $30M | Jul 23, 2024 | $50M |

| Nilus | 2022 | New York, NY, USA | 11-50 | $10M | Jan 16, 2025 | $18.6M |

| Dub | 2021 | New York, NY, USA | 11-50 | $15M | Feb 22, 2024 | $17M |

| UPTIQ | 2022 | Plano, TX, USA | 11-50 | $20.49M | Oct 23, 2024 | $32.49M |

| Almond FinTech | 2020 | Boston, MA, USA | 11-50 | $2M | Oct 1, 2024 | $11M |

| Lettuce Financial | 2023 | San Francisco, CA, USA | 11-50 | $15M | Aug 21, 2024 | $21M |

| Rainforest | 2022 | Atlanta, GA, USA | 11-50 | $20M | Jun 26, 2024 | $31.75M |

| Caliza | 2021 | Miami, FL, USA | 1-10 | $8.5M | Jul 15, 2024 | $13.8M |

| Conduit | 2021 | Boston, MA, USA | 11-50 | $6M | Aug 12, 2024 | $23M |

| Agora | 2024 | Delaware, OH, USA | 1-10 | $12M | Apr 2, 2024 | $12M |

| Functional Finance | 2021 | San Francisco, CA, USA | 1-10 | $20M | May 30, 2024 | $34M |

| Carry | 2022 | Brooklyn, NY, USA | 11-50 | $10M | Jul 17, 2024 | $14.5M |

| Tesouro | 2021 | Miami, FL, USA | 11-50 | $14.4M | Nov 5, 2024 | $42.4M |

| Cynch AI | 2022 | San Francisco, CA, USA | 11-50 | $18.7M | Nov 1, 2024 | $24.98M |

| Kinto | 2023 | Orlando, FL, USA | 1-10 | $5M | Jul 9, 2024 | $10M |

| arqu | 2020 | San Francisco, CA, USA | 1-10 | $10M | Sep 22, 2024 | $13.5M |

| Valstro | 2021 | New York, NY, USA | 51-100 | $23.5M | Jun 13, 2024 | $23.5M |

| SquareDash | 2022 | Fort Worth, TX, USA | 1-10 | $15M | Mar 14, 2024 | $20.2M |

1. Infinant

- Founded: 2021

- Location: Charlotte, North Carolina, USA

- Industry: Financial Services, FinTech, Productivity Tools

- Number of Employees: 11-50

- Last Funding Amount: $15M (Latest Round: December 23, 2024)

- Total Funding Amount: $20M

Infinant is a financial technology company revolutionizing embedded finance solutions for businesses and financial institutions. Their platform enables seamless integration of banking services, empowering enterprises to offer financial products without the complexity of traditional banking infrastructure.

By leveraging modern APIs and cloud-native technology, Infinant helps businesses embed payments, lending, and account management into their workflows. Their scalable and secure platform enhances operational efficiency, providing innovative financial solutions that drive growth and customer engagement.

2. RLTYco

- Founded: 2021

- Location: New York, New York, USA

- Industry: Financial Services

- Number of Employees: 11-50

- Last Funding Amount: $20M (Latest Round: January 9, 2025)

- Total Funding Amount: $20M

RLTYco is a financial services company focused on revolutionizing real estate investment and asset management. By leveraging advanced technology and data-driven insights, RLTYco enables investors to efficiently manage and maximize their real estate portfolios.

Their platform offers innovative financial solutions that simplify real estate transactions, enhance liquidity, and optimize returns. With a commitment to transparency and efficiency, RLTYco is redefining how investors engage with the real estate market.

3. Strive Asset Management

- Founded: 2022

- Location: Columbus, Ohio, USA

- Industry: Financial Services

- Number of Employees: 11-50

- Last Funding Amount: $30M (Latest Round: July 23, 2024)

- Total Funding Amount: $50M

Strive Asset Management is a forward-thinking financial services firm committed to providing innovative investment strategies that maximize long-term value for its clients. With a focus on strategic growth and value creation, Strive offers a range of tailored asset management services designed to help investors achieve their financial goals.

By combining data-driven insights, rigorous analysis, and a commitment to responsible investing, Strive aims to deliver superior returns while aligning with the broader interests of clients. The firm’s approach is grounded in a strong belief in the power of active, disciplined management to drive sustainable success.

4. Nilus

- Founded: 2022

- Location: New York, New York, USA

- Industry: Financial Services, FinTech, Payments

- Number of Employees: 11-50

- Last Funding Amount: $10M (Latest Round: January 16, 2025)

- Total Funding Amount: $18.6M

Nilus is a FinTech company dedicated to transforming the way businesses handle payments. Their innovative platform simplifies payment processes, making transactions faster, more secure, and cost-effective. Focused on streamlining financial services, Nilus is helping businesses of all sizes improve efficiency and reduce friction in their payment operations.

By leveraging cutting-edge technology and offering a user-friendly interface, Nilus provides seamless integration with existing financial systems. This enables businesses to scale their operations and manage their finances with greater flexibility. Nilus continues to evolve its platform, ensuring that it meets the ever-growing demands of the digital payments landscape.

5. Dub

- Founded: 2021

- Location: New York, New York, USA

- Industry: Financial Services, Mobile Apps, Trading Platform

- Number of Employees: 11-50

- Last Funding Amount: $15M (Latest Round: February 22, 2024)

- Total Funding Amount: $17M

Dub is a cutting-edge trading platform designed to empower investors with seamless access to financial markets through an intuitive mobile app. Focused on democratizing trading, Dub aims to simplify the investment process for individuals and businesses by providing an easy-to-use platform with powerful features.

The app allows users to make smarter investment decisions by offering real-time market data, advanced tools, and analytics. With an emphasis on user experience and security, Dub ensures that users can trade with confidence, no matter their level of experience.

6. UPTIQ

- Founded: January 2022

- Location: Plano, Texas, USA

- Industry: Financial Services, FinTech, Lending

- Number of Employees: 11-50

- Last Funding Amount: $20.49M (Latest Round: October 23, 2024)

- Total Funding Amount: $32.49M

UPTIQ is a financial technology company that is transforming the lending industry by utilizing AI-driven solutions to streamline access to credit. The company offers innovative lending platforms designed to improve the speed and accuracy of loan decision-making, enhancing the borrowing experience for businesses and individuals.

With a focus on data-driven insights, UPTIQ’s platform helps reduce risk and optimize lending processes for both lenders and borrowers. Through advanced algorithms, it provides a seamless, fast, and secure way to navigate credit opportunities.

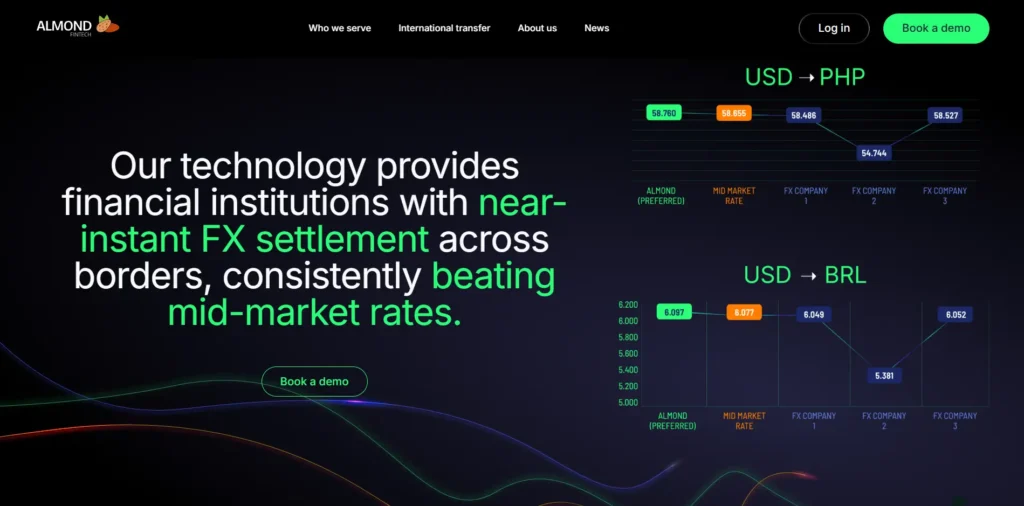

7. Almond FinTech

- Founded: 2020

- Location: Boston, Massachusetts, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $2M (Latest Round: October 1, 2024)

- Total Funding Amount: $11M

Almond FinTech is a cutting-edge financial technology company focused on enhancing digital payment solutions and simplifying financial services for individuals and businesses. The company’s innovative platform is designed to provide seamless, secure, and efficient payment processing, offering businesses a competitive edge in the fast-evolving financial sector.

Almond FinTech uses advanced technology to ensure faster transaction processing times and superior security for their clients. With an emphasis on improving financial inclusion, Almond FinTech is committed to bridging the gap between traditional finance and the future of digital payments.

8. Lettuce Financial

- Founded: May 24, 2023

- Location: San Francisco, California, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $15M (Latest Round: August 21, 2024)

- Total Funding Amount: $21M

Lettuce Financial is a forward-thinking fintech company focused on transforming how businesses and individuals manage their financial services. By providing innovative tools and solutions, Lettuce Financial simplifies complex financial tasks, making them more accessible and efficient. Their platform offers a user-friendly experience, enabling businesses to manage their finances seamlessly.

The company’s cutting-edge technology aims to address gaps in traditional financial systems by streamlining financial processes, improving compliance, and enabling faster, more secure transactions. Lettuce Financial’s mission is to empower businesses with the tools they need to thrive in today’s competitive market.

9. Rainforest

- Founded: January 2022

- Location: Atlanta, Georgia, USA

- Industry: Financial Services, FinTech, Payments

- Number of Employees: 11-50

- Last Funding Amount: $20M (Latest Round: June 26, 2024)

- Total Funding Amount: $31.75M

Rainforest is an innovative financial services company revolutionizing payments through its advanced fintech platform. Based in Atlanta, Georgia, the company is dedicated to creating solutions that streamline payment processing for businesses and consumers alike. Rainforest’s platform is designed to simplify the complexities of financial transactions, making them faster, more secure, and cost-effective.

By focusing on enhancing payment systems and integrating modern technologies, Rainforest aims to improve the payment experience for businesses, enabling them to manage payments efficiently across different markets. With an eye on the future, Rainforest continues to innovate, aiming to be a leading provider in the financial services space.

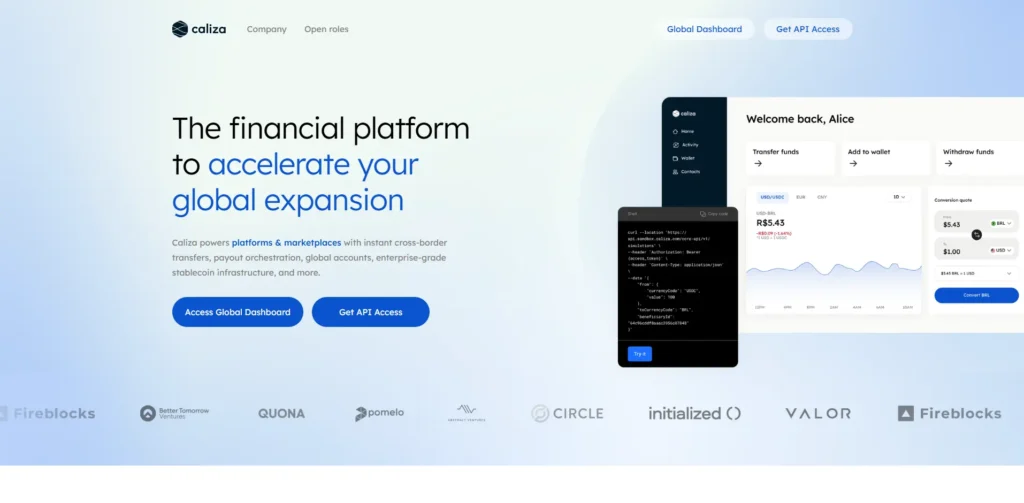

10. Caliza

- Founded: 2021

- Location: Miami, Florida, USA

- Industry: Financial Services, FinTech, Software

- Number of Employees: 1-10

- Last Funding Amount: $8.5M (Latest Round: July 15, 2024)

- Total Funding Amount: $13.8M

Caliza is a cutting-edge financial services company based in Miami, Florida, that is transforming the fintech and software industry. Specializing in providing innovative solutions for businesses, Caliza’s platform offers a seamless and efficient way to handle financial operations. The company’s focus on integrating software solutions with financial services enables businesses to optimize their workflows and boost productivity.

With a commitment to simplifying complex financial tasks and providing high-quality tools for businesses, Caliza continues to push the boundaries of what’s possible in the world of fintech. The company is positioned to continue growing and offering powerful, user-friendly solutions to help businesses thrive.

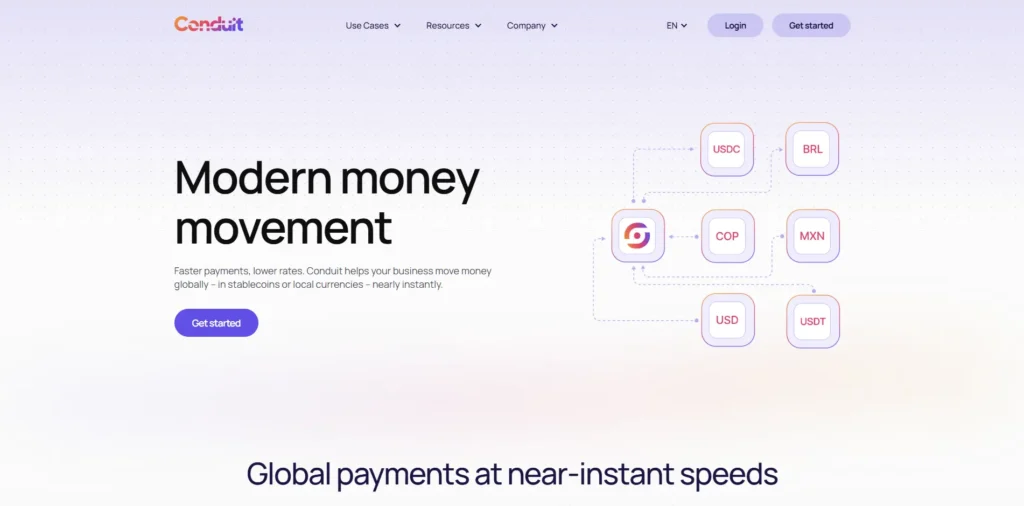

11. Conduit

- Founded: 2021

- Location: Boston, Massachusetts, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $6M (Latest Round: August 12, 2024)

- Total Funding Amount: $23M

Conduit is a forward-thinking fintech company based in Boston, Massachusetts, revolutionizing the financial services sector. By providing innovative payment solutions, Conduit simplifies and accelerates payment processes for businesses, helping them improve operational efficiency. The company’s platform is designed to streamline transactions, reduce costs, and enhance overall payment experiences for its clients.

With a focus on empowering businesses with advanced financial tools, Conduit continues to push the envelope in delivering seamless payment solutions. The company’s ongoing commitment to growth and technological innovation positions it as a key player in transforming the fintech landscape.

12. Agora

- Founded: 2024

- Location: Delaware, Ohio, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Last Funding Amount: $12M (Latest Round: April 2, 2024)

- Total Funding Amount: $12M

Agora is a dynamic financial services company based in Delaware, Ohio, focused on offering innovative solutions within the fintech industry. With its unique platform, Agora aims to provide users with more accessible and efficient ways to manage their financial needs, ensuring smooth and secure financial transactions.

By combining cutting-edge technology with expert financial knowledge, Agora strives to empower individuals and businesses alike, making financial management simpler and more effective. The company’s rapid growth and recent funding highlight its potential in reshaping the financial services landscape.

13. Functional Finance

- Founded: 2021

- Location: San Francisco, California, USA

- Industry: Financial Services, FinTech

- Number of Employees: 1-10

- Last Funding Amount: $20M (Latest Round: May 30, 2024)

- Total Funding Amount: $34M

Functional Finance is an innovative fintech company based in San Francisco, offering advanced solutions for managing personal and business finances. The company’s platform simplifies complex financial operations, helping users make smarter financial decisions with ease.

Functional Finance focuses on integrating technology and finance to streamline everyday financial management, providing tools that enhance budgeting, investing, and expense tracking. With a vision to revolutionize the financial services industry, Functional Finance has quickly become a leader in providing efficient, user-friendly financial solutions.

14. Carry

- Founded: 2022

- Location: Brooklyn, New York, USA

- Industry: Financial Services, Wealth Management

- Number of Employees: 11-50

- Last Funding Amount: $10M (Latest Round: July 17, 2024)

- Total Funding Amount: $14.5M

Carry is a fintech company revolutionizing wealth management by providing personalized and efficient financial solutions for individuals and businesses. Based in Brooklyn, Carry’s platform allows users to seamlessly manage and grow their wealth using cutting-edge technology.

The company focuses on simplifying financial decision-making by offering tools for investment tracking, portfolio management, and retirement planning, ensuring that users are equipped to make informed financial decisions. Carry’s user-friendly interface and commitment to financial empowerment make it a standout in the wealth management space.

15. Tesouro

- Founded: August 5, 2021

- Location: Miami, Florida, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $14.4M (Latest Round: November 5, 2024)

- Total Funding Amount: $42.4M

Tesouro is a Miami-based fintech company that provides innovative financial services to individuals and businesses, with a focus on optimizing wealth management. The platform offers a suite of tools that streamline financial decision-making, enabling users to manage their investments and assets with ease.

Tesouro’s services are designed to simplify the complexities of financial planning, with features that allow for personalized strategies tailored to each user’s goals. By leveraging technology, Tesouro helps users maximize their financial potential in an ever-changing economic landscape.

16. Cynch AI

- Founded: 2022

- Location: San Francisco, California, USA

- Industry: Financial Services, FinTech

- Number of Employees: 11-50

- Last Funding Amount: $18.7M (Latest Round: November 1, 2024)

- Total Funding Amount: $24.98M

Cynch AI is a cutting-edge fintech company that leverages artificial intelligence to revolutionize financial services. The platform uses AI-driven algorithms to optimize financial planning, lending, and wealth management, providing tailored solutions for both individuals and businesses.

By harnessing the power of machine learning and big data, Cynch AI offers a more efficient, accurate, and personalized approach to financial decision-making. The company’s solutions help users make smarter financial choices and manage risks more effectively, transforming the way people and organizations handle their finances.

17. Kinto

- Founded: 2023

- Location: Orlando, Florida, USA

- Industry: Financial Services, Software

- Number of Employees: 1-10

- Last Funding Amount: $5M (Latest Round: July 9, 2024)

- Total Funding Amount: $10M

Kinto is an innovative fintech startup focused on creating software solutions that simplify financial management for businesses and individuals. With a user-friendly platform, Kinto enables efficient financial planning, budgeting, and expense tracking, giving users complete control over their financial activities.

The company’s goal is to enhance financial decision-making by offering advanced tools and insights that help users optimize their financial strategies. As Kinto grows, it continues to focus on leveraging technology to streamline financial processes and support smarter financial habits.

18. arqu

- Founded: 2020

- Location: San Francisco, California, USA

- Industry: Financial Services, Insurance

- Number of Employees: 1-10

- Last Funding Amount: $10M (Latest Round: September 22, 2024)

- Total Funding Amount: $13.5M

arqu is a forward-thinking insurance company redefining the way insurance is accessed and managed. Their platform offers innovative, user-friendly solutions for individuals and businesses, aiming to simplify and improve the insurance experience. By focusing on technology-driven solutions, Arqu delivers personalized insurance options with a focus on customer satisfaction and efficiency.

The company’s vision is to make insurance more accessible and transparent, using advanced technologies to bring affordable and flexible coverage to the masses.

19. Valstro

- Founded: 2021

- Location: New York, USA

- Industry: Financial Services

- Number of Employees: 51-100

- Last Funding Amount: $23.5M (Latest Round: June 13, 2024)

- Total Funding Amount: $23.5M

Valstro is a dynamic financial services company focused on delivering innovative solutions in the financial sector. With a strong emphasis on growth and technology, Valstro aims to transform traditional financial models by providing more efficient, transparent, and accessible financial services to a wide range of clients.

The company leverages cutting-edge technology to offer a variety of services tailored to meet the needs of its diverse client base, from individuals to businesses. Valstro is committed to simplifying complex financial processes while ensuring that its clients are empowered with the right tools to achieve their financial goals.

20. SquareDash

- Founded: 2022

- Location: Fort Worth, USA

- Industry: Financial Services

- Number of Employees: 1-10

- Last Funding Amount: $15M (Latest Round: March 14, 2024)

- Total Funding Amount: $20.2M

SquareDash is a cutting-edge financial services company designed to streamline and enhance the financial experience for individuals and businesses alike. By combining innovative technologies with personalized service, SquareDash aims to make financial management more accessible and efficient.

With a focus on providing user-friendly solutions, SquareDash offers a variety of services designed to simplify complex financial processes, providing its clients with the tools they need to better manage their finances. The company is dedicated to continuously enhancing its platform, ensuring that it stays at the forefront of the financial services industry.

Conclusion

The wave of financial innovation is accelerating, and these 20 fintech startups securing $10M–$50M in recent years are proof. They’re transforming everything from payments and lending to wealth management and financial infrastructure. By embracing digital-first models and customer-centric solutions, these innovators are reshaping how individuals and businesses manage, move, and grow their money—bringing speed, simplicity, and smarter financial access to a global audience.

FAQs

Q. What are some examples of innovations in the financial sector from these startups?

Answer: These startups are leveraging cutting-edge technologies like artificial intelligence (AI), blockchain, decentralized finance (DeFi), and machine learning to create more efficient, secure, and accessible financial solutions. Some are focused on AI-powered banking, while others are developing innovative payment solutions and wealth management tools.

Q. How can these startups help businesses and consumers?

Answer: These startups provide businesses and consumers with smarter financial solutions that improve efficiency, reduce costs, and enhance security. Whether it’s through innovative lending platforms, digital banking options, or decentralized finance systems, these companies are making it easier for both businesses and consumers to manage their finances.

Q. What types of financial services do these startups offer?

Answer: These startups are focused on a range of financial services, including digital banking, payment processing, lending, wealth management, AI-powered financial tools, blockchain solutions, and decentralized finance (DeFi).