San Francisco’s innovation engine is running strong, and these 20 startups are proof. With $10M–$50M in recent funding, they’re scaling ambitious technologies across sectors like AI, fintech, healthtech, climate, and enterprise software. Backed by major investors, they’re building solutions designed for impact at scale.

20 Growth-Stage Startups Driving the Bay Area’s Tech Momentum

With solid traction, expanding teams, and global ambitions, these companies are shaping the future of tech from the heart of San Francisco.

Let’s meet the startups turning fresh capital into forward momentum

| Company | Founded | Industry | Employees | Last Funding Amount | Last Round Date | Total Funding Amount |

|---|---|---|---|---|---|---|

| interface.ai | 2019 | Enterprise Software, FinTech | 51–100 | $20M | Oct 22, 2024 | $30M |

| Framework | 2019 | Consumer Electronics | 51–100 | $17M | Apr 23, 2024 | $45M |

| Orderful | 2016 | Logistics, Manufacturing | 51–100 | $15M | Nov 13, 2024 | $44M |

| Atlas | 2019 | Finance, Financial Services | 11–50 | $27M | Dec 12, 2024 | $27M |

| Candid Health | 2019 | Billing, Health Care | 11–50 | $29M | Sep 11, 2024 | $47.30M |

| Alessa Therapeutics | 2018 | Biotechnology, Health Care | 1–10 | $15M | Dec 12, 2024 | $21.26M |

| Bounce | 2018 | Logistics, Mobile | 11–50 | $19M | Nov 12, 2024 | $34.20M |

| Builder.io | 2019 | Developer Tools, Software | 51–100 | $20M | Apr 24, 2024 | $37.25M |

| Siren Care | 2016 | Health Care, Medical Device | 11–50 | $9.50M | Jan 8, 2025 | $40.55M |

| Pallet | 2019 | Business Intelligence, Fleet Management | 11–50 | $18M | Oct 2, 2024 | $21M |

| kegg | 2017 | Fertility, Health Care | 1–10 | $6.50M | Jan 14, 2025 | $11M |

| Alembic | 2018 | Big Data, Business Intelligence | 11–50 | $15.97M | Feb 15, 2024 | $25.62M |

| Pair Team | 2017 | Health Care, Hospital | 11–50 | $0.5M | Jun 10, 2024 | $19.5M |

| General Proximity | 2019 | Biotechnology, Medical | 11–50 | $16M | Jan 3, 2025 | $16M |

| Loft Labs | 2019 | Cloud Computing, Cloud Management | 11–50 | $24M | Apr 16, 2024 | $28.60M |

| Fairbanc | 2017 | E-Commerce, Small and Medium Businesses | 11–50 | IDR 50B / ~$3.13M | Dec 18, 2024 | $41.25M |

| Lava | 2016 | Artificial Intelligence (AI), Consulting | 11–50 | $33.76M | Sep 27, 2024 | $33.76M |

| TeamBridge | 2019 | Artificial Intelligence (AI), Business Process Automation (BPA) | 11–50 | $28M | Sep 16, 2024 | $31.10M |

| Epic Cleantec | 2015 | CleanTech, Natural Resources | 11–50 | $12M | Nov 21, 2024 | $25.36M |

| Freshpaint | 2019 | Analytics, Data Mining | 51–100 | $30.70M | Jul 16, 2024 | $46.85M |

1. interface.ai

- Founded: Mar 26, 2019

- Location: San Francisco, California

- Industry: Enterprise Software, FinTech

- Number of Employees: 51–100

- Last Funding Amount: $20M (Latest Round: Oct 22, 2024)

- Total Funding Amount: $30M

interface.ai builds AI-powered enterprise software that empowers financial services teams to automate document processing, client onboarding, and risk workflows. By combining machine learning with industry-specific insights, the platform enhances accuracy, compliance, and operational efficiency, supporting institutions in scaling with confidence.

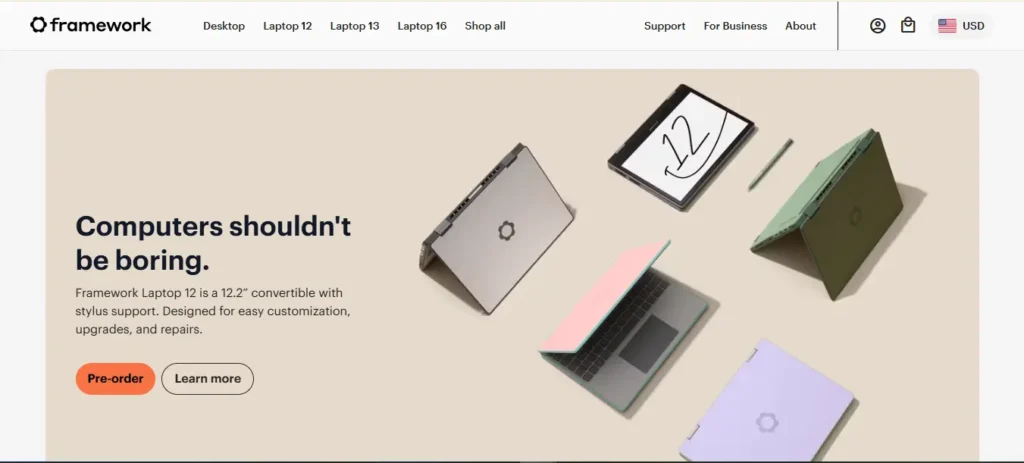

2. Framework

- Founded: Dec 2019

- Location: San Francisco, California

- Industry: Consumer Electronics

- Number of Employees: 51–100

- Last Funding Amount: $17M (Latest Round: Apr 23, 2024)

- Total Funding Amount: $45M

Framework designs and manufactures modular laptops engineered for repairability and upgradability. Their platform allows users to easily swap components—from memory and storage to expansion cards—extending device lifespan and reducing electronic waste. With a focus on sustainability and user empowerment, Framework is reshaping the consumer electronics landscape.

3. Orderful

- Founded: 2016

- Location: San Francisco, California

- Industry: Logistics, Manufacturing

- Number of Employees: 51–100

- Last Funding Amount: $15M (Latest Round: Nov 13, 2024)

- Total Funding Amount: $44M

Orderful enables seamless supply-chain collaboration through a cloud-based EDI (Electronic Data Interchange) platform. Its service connects manufacturers, logistics providers, and retailers to automate order workflows, reduce integration complexity, and accelerate operations. By centralizing transaction data and modernizing legacy systems, Orderful helps enterprises improve accuracy, speed, and visibility across the supply chain.

4. Atlas

- Founded: 2019

- Location: San Francisco, California

- Industry: Finance, Financial Services

- Number of Employees: 11–50

- Last Funding Amount: $27M (Latest Round: Dec 12, 2024)

- Total Funding Amount: $27M

Atlas provides embedded financial services tailored for modern startups and scale-ups. Their platform offers customizable banking, credit, and payments capabilities via API, enabling tech companies to integrate seamless financial functionality into their products. By focusing on developer-friendly tools and regulatory compliance, Atlas empowers businesses to scale financial infrastructure with speed and flexibility.

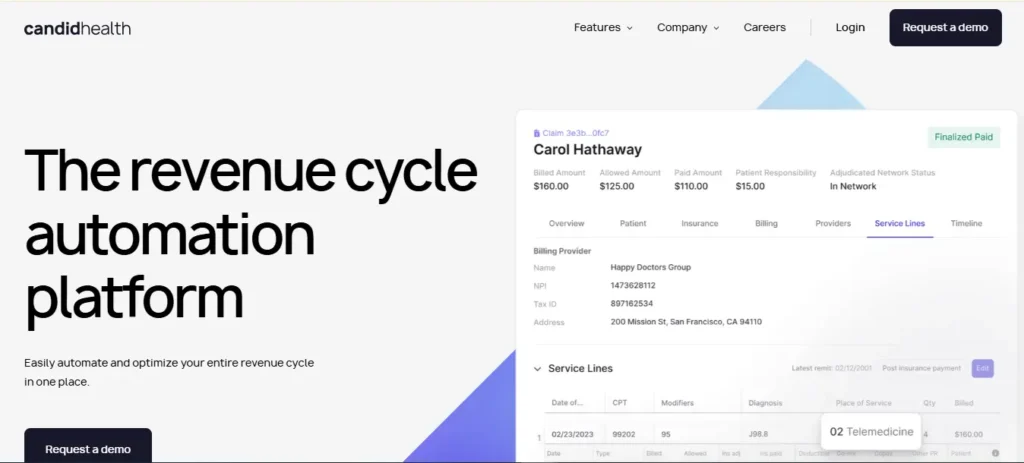

5. Candid Health

- Founded: Jul 2019

- Location: San Francisco, California

- Industry: Billing, Health Care

- Number of Employees: 11–50

- Last Funding Amount: $29M (Latest Round: Sep 11, 2024)

- Total Funding Amount: $47.30M

Candid Health delivers an intelligent billing platform designed to simplify healthcare revenue cycles. Leveraging AI and automation, the company helps providers reduce denials, accelerate reimbursements, and optimize administrative processes. Its user-friendly interface offers actionable insights for managing claims and compliance, empowering medical practices to focus on patient care instead of paperwork.

6. Alessa Therapeutics

- Founded: 2018

- Location: San Francisco, California

- Industry: Biotechnology, Health Care

- Number of Employees: 1–10

- Last Funding Amount: $15M (Latest Round: Dec 12, 2024)

- Total Funding Amount: $21.26M

Alessa Therapeutics is developing novel therapies that harness biological insights to treat chronic diseases. Their pipeline focuses on innovative biomolecular treatments aimed at immune modulation and tissue regeneration. With strong scientific foundations, Alessa is advancing promising therapeutic candidates to improve patient outcomes and address unmet medical needs.

7. Bounce

- Founded: 2018

- Location: San Francisco, California

- Industry: Logistics, Mobile

- Number of Employees: 11–50

- Last Funding Amount: $19M (Latest Round: Nov 12, 2024)

- Total Funding Amount: $34.20M

Bounce offers a mobile-first logistics solution that connects users with on-demand storage and transportation services. Their platform empowers individuals and businesses to seamlessly manage delivery, warehousing, and moving needs via a trusted marketplace. With real-time tracking, transparent pricing, and a nationwide network of providers, Bounce is modernizing last-mile logistics and city storage management.

8. Builder.io

- Founded: September 2019

- Location: San Francisco, California

- Industry: Developer Tools, Software

- Number of Employees: 51–100

- Last Funding Amount: $20M (Latest Round: April 24, 2024)

- Total Funding Amount: $37.25M

Builder.io offers a visual development platform that enables teams to build and optimize web and app content without code. By combining drag-and-drop capabilities with powerful APIs, it empowers designers and developers to collaborate seamlessly. The platform helps companies accelerate digital delivery, improve performance, and customize user experiences at scale.

9. Siren Care

- Founded: 2016

- Location: San Francisco, California

- Industry: Health Care, Medical Device

- Number of Employees: 11–50

- Last Funding Amount: $9.50M (Latest Round: Jan 8, 2025)

- Total Funding Amount: $40.55M

Siren Care develops smart wearable devices combined with AI-driven sensors to monitor foot temperature and prevent diabetic complications. Their clinically validated socks use predictive algorithms to detect early signs of ulceration, enabling timely interventions. With a focus on improving patient outcomes and reducing healthcare costs, Siren Care empowers individuals and providers with proactive diabetic care tools.

10. Pallet

- Founded: 2019

- Location: San Francisco, California

- Industry: Business Intelligence, Fleet Management

- Number of Employees: 11–50

- Last Funding Amount: $18M (Latest Round: Oct 2, 2024)

- Total Funding Amount: $21M

Pallet delivers an AI-powered business intelligence platform tailored for fleet and logistics operations. Their software integrates telematics and real-time vehicle data to optimize routing, safety compliance, and cost-efficiency. With powerful analytics and predictive modeling, Pallet helps companies manage fleets smarter, reducing downtime and improving operational performance.

11. kegg

- Founded: Jul 21, 2017

- Location: San Francisco, California

- Industry: Fertility, Health Care

- Number of Employees: 1–10

- Last Funding Amount: $6.50M (Latest Round: Jan 14, 2025)

- Total Funding Amount: $11M

kegg offers an FDA-cleared fertility tracking device combined with an AI-driven mobile app. It monitors key physiological indicators like electrolyte levels to accurately predict ovulation and fertility windows. By delivering personalized insights and cycle health data, kegg empowers users to optimize family planning. Their wearable-and-app ecosystem seamlessly integrates into daily life and supports informed reproductive health decisions.

12. Alembic

- Founded: Nov 1, 2018

- Location: San Francisco, California

- Industry: Big Data, Business Intelligence

- Number of Employees: 11–50

- Last Funding Amount: $15.97M (Latest Round: Feb 15, 2024)

- Total Funding Amount: $25.62M

Alembic is an AI-powered marketing intelligence platform designed for enterprise-level organizations. It ingests vast amounts of data from various marketing channels—including digital, TV, radio, and out-of-home media—to provide real-time insights into campaign performance and revenue attribution. By leveraging advanced causal AI and proprietary algorithms, Alembic enables CMOs to make data-driven decisions that optimize marketing spend and maximize ROI.

13. Pair Team

- Founded: July 21, 2017

- Location: San Francisco, California

- Industry: Health Care, Hospital

- Number of Employees: 11–50

- Last Funding Amount: $0.5M (Latest Round: June 10, 2024)

- Total Funding Amount: $19.5M

Pair Team is a digital health startup that partners with community-based organizations to provide whole-person care to Medicaid patients. By integrating medical, mental health, and social services, they aim to improve health outcomes for underserved populations. Their model emphasizes trust-building and accessibility, meeting patients where they are—be it in shelters, food pantries, or through virtual care.

14. General Proximity

- Founded: 2019

- Location: San Francisco, California

- Industry: Biotechnology, Medical

- Number of Employees: 11–50

- Last Funding Amount: $16M (Latest Round: Jan 3, 2025)

- Total Funding Amount: $16M

General Proximity is a biotech company pioneering next-generation proximity medicines aimed at targeting traditionally undruggable proteins. Their proprietary OmniTAC platform enables precise modulation of disease-driving proteins by controlling molecular proximity, offering therapeutic opportunities in oncology, cardiometabolic diseases, neurodegeneration, and longevity.

15. Loft Labs

- Founded: 2019

- Location: San Francisco, California

- Industry: Cloud Computing, Cloud Management

- Number of Employees: 11–50

- Last Funding Amount: $24M (Latest Round: Apr 16, 2024)

- Total Funding Amount: $28.60M

Loft Labs is a cloud-native infrastructure company specializing in virtualizing Kubernetes clusters. Their flagship product, vCluster, enables organizations to create lightweight virtual Kubernetes clusters that share a common underlying platform stack, optimizing resource utilization and simplifying management. In April 2024, Loft Labs secured $24 million in Series A funding led by Khosla Ventures, with participation from Fusion Fund, Surface Ventures, Emergent Ventures, and Berkeley SkyDeck Fund.

16. Fairbanc

- Founded: April 2, 2017

- Location: San Francisco, California

- Industry: E-Commerce, Small and Medium Businesses

- Number of Employees: 11–50

- Last Funding Amount: IDR 50B / ~$3.13M (Latest Round: Dec 18, 2024)

- Total Funding Amount: $41.25M

Fairbanc is a fintech startup providing Buy Now, Pay Later (BNPL) solutions to underserved micro and small businesses across Southeast Asia. Its AI-driven credit assessment uses supply chain data to extend collateral-free financing—no credit history or digital literacy required. With partnerships from Unilever to Danone, Fairbanc has already onboarded over 250,000 merchants, driving financial inclusion at scale. Its recent $3M debt raise from Indonesia’s Bahana Artha Ventura brings its total capital to over $41M.

17. Lava

- Founded: 2016

- Location: San Francisco, California

- Industry: Artificial Intelligence (AI), Consulting

- Number of Employees: 11–50

- Last Funding Amount: $33.76M (Latest Round: Sep 27, 2024)

- Total Funding Amount: $33.76M

Lava is an AI-powered consulting platform that transforms how enterprises interact with data, insights, and automation. It delivers tailored AI solutions across sectors like finance, healthcare, and supply chain, helping clients unlock operational efficiency and innovation. With a recent $33.76M raise, Lava is scaling its custom LLM and data infrastructure offerings, cementing its position as a trusted AI partner for enterprise transformation.

18. TeamBridge

- Founded: 2019

- Location: San Francisco, California

- Industry: Artificial Intelligence (AI), Business Process Automation (BPA)

- Number of Employees: 11–50

- Last Funding Amount: $28M (Latest Round: Sep 16, 2024)

- Total Funding Amount: $31.10M

TeamBridge is an AI-native workforce operations platform that streamlines hiring, onboarding, task management, and communications, particularly for frontline and deskless teams. Designed for industries like retail, logistics, and hospitality, it bridges HR and operations into a single, intuitive system. With a fresh $28M infusion, TeamBridge is scaling its platform to serve a broader set of enterprise customers, further automating day-to-day workflows for operational teams across North America.

19. Epic Cleantec

- Founded: 2015

- Location: San Francisco, California

- Industry: CleanTech, Natural Resources

- Number of Employees: 11–50

- Last Funding Amount: $12M (Latest Round: Nov 21, 2024)

- Total Funding Amount: $25.36M

Epic Cleantec builds sustainable water reuse systems that turn building wastewater into clean water, renewable energy, and soil nutrients. Its on-site water recycling technology helps urban buildings drastically reduce water usage and environmental footprint. With $12M in new funding, the company is accelerating commercial adoption of its closed-loop systems, helping cities combat water scarcity while advancing green infrastructure.

20. Freshpaint

- Founded: Jan 1, 2019

- Location: San Francisco, California

- Industry: Analytics, Data Mining

- Number of Employees: 51–100

- Last Funding Amount: $30.70M (Latest Round: Jul 16, 2024)

- Total Funding Amount: $46.85M

Freshpaint helps businesses collect and manage customer data with minimal engineering effort, enabling better personalization, marketing, and analytics. Its platform automates event tracking and ensures compliance with privacy regulations like HIPAA and GDPR. With a recent $30.7M raise, Freshpaint is expanding integrations and scaling its data infrastructure to power secure, real-time insights for modern digital teams.

Conclusion

With $10M–$50M in new funding, these 20 San Francisco startups are accelerating growth and deepening their impact across industries. From AI and healthtech to fintech and clean energy, they’re building bold solutions designed to scale. Backed by strong investor confidence, they represent the next wave of innovation shaping the city’s—and the world’s—tech future.

FAQs

Q1. Which sectors are most represented?

A. Key sectors include artificial intelligence, fintech, digital health, enterprise software, sustainability, and mobility.

Q2. How are they using the $10M–$50M in funding?

A. Funding is being allocated to scaling teams, entering new markets, enhancing product features, and accelerating customer acquisition.

Q3. What’s next for these companies?

A. Continued scaling, key partnerships, and preparation for late-stage rounds or strategic exits as they solidify market leadership.