The Information Technology sector continues to evolve rapidly, driven by innovation and venture capital investment. From AI and cloud computing to cybersecurity and SaaS, VC firms are playing a crucial role in shaping the future of IT. In this blog, we highlight the top venture capital firms and investors who are actively funding IT startups, driving technological advancements, and fueling the next wave of digital transformation. Whether you’re a startup founder seeking funding or just curious about the key players in IT investments, this list will provide valuable insights.

Meet the Investors Behind the Biggest IT Breakthroughs

Below is a list of top VC firms and investors actively funding the Information Technology sector. These firms are backing groundbreaking startups, cutting-edge innovations, and disruptive technologies that are shaping the future of IT. From early-stage funding to multi-million-dollar investments, these investors fuel growth in areas like AI, cloud computing, cybersecurity, and more. Let’s take a closer look at the key players and their recent investments.

1. Madrona

- Investment Stage: Early Stage Venture, Late Stage Venture, Post-IPO, Seed, Venture

- Number of Companies Invested: 525

- Number of Lead Investments: 194 (, etc)

- Location: Seattle, WA

- Founded Year: 1995

- Investor Type: Venture Capital

Madrona is a Seattle-based venture capital firm that has been fueling innovation since 1995. With 525 investments and 194 lead deals, it supports companies from early-stage to post-IPO. Focused on the Pacific Northwest and beyond, Madrona backs groundbreaking information technology startups, helping them grow with funding, expert guidance, and strategic support.

2. DCVC

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 515

- Number of Lead Investments: 94 (Reach, Verdigris Technologies, etc)

- Location: Palo Alto, CA

- Founded Year: 2011

- Investor Type: Venture Capital

DCVC is a Palo Alto-based venture capital firm investing in cutting-edge technology since 2011. With 515 investments and 94 lead deals, it supports startups in information technology and beyond. DCVC helps innovative companies scale, thrive, and transform industries by combining venture capital and private equity strategies.

3. Crosslink Capital

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 482

- Number of Lead Investments: 159 (UserEvidence, Inscribe, Abstract Security, etc)

- Location: Menlo Park, CA

- Founded Year: 1989

- Investor Type: Venture Capital

Crosslink Capital is a Menlo Park-based venture capital firm that has been backing innovative startups since 1989. With 482 investments and 159 lead deals, it focuses on early-stage companies in information technology. By partnering with market disruptors and category creators, Crosslink helps visionary founders scale and shape the future.

4. MassVentures

- Investment Stage: Early Stage Venture, Grant, Late Stage Venture, Seed

- Number of Companies Invested: 435

- Number of Lead Investments: 93 (Stitch3D, Pison, etc)

- Location: Boston, MA

- Founded Year: 1978

- Investor Type: Venture Capital

MassVentures is a Boston-based venture capital firm dedicated to helping Massachusetts startups grow and succeed. Since 1978, it has invested in 435 companies, leading 93 deals in fields like information technology. With a strong focus on innovation, MassVentures provides funding and guidance to help entrepreneurs bring their ideas to life.

5. Dreamit Ventures

- Investment Stage: Convertible Note, Early Stage Venture, Non-Equity Assistance, Seed, Venture

- Number of Companies Invested: 405

- Number of Lead Investments: 86 (Graphus, Digitize.AI, etc)

- Location: Philadelphia, PA

- Founded Year: 2007

- Investor Type: Venture Capital

Dreamit Ventures is a Philadelphia-based venture fund that helps startups scale and grow. Since 2007, it has invested in 405 companies, leading 86 deals in fields like information technology. Focused on startups with pilots or revenue, Dreamit provides funding and mentorship to help entrepreneurs turn their innovative ideas into successful businesses.

6. ff Venture Capital

- Investment Stage: Debt, Early Stage Venture, Late Stage Venture, Seed

- Number of Companies Invested: 373

- Number of Lead Investments: 64 (Respeecher, Cryptiony, EyeVi Technologies, etc)

- Location: New York, NY

- Founded Year: 2008

- Investor Type: Venture Capital

ff Venture Capital is a New York-based venture firm that invests in cutting-edge technology startups. Since 2008, it has backed 373 companies, leading 64 investments in areas like cybersecurity, AI, machine learning, drones, and cloud software. With a focus on innovation, ff Venture Capital helps early and late-stage startups grow and succeed.

7. Accomplice

- Investment Stage: Early Stage Venture, Initial Coin Offering, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 370

- Number of Lead Investments: 95 (Secureframe, Electives, NEAR, etc)

- Location: Cambridge, MA

- Founded Year: 2015

- Investor Type: Family Investment Office, Venture Capital

Accomplice is a Cambridge-based venture capital firm focused on backing innovative technology startups. Since 2015, it has invested in 370 companies, leading 95 key investments in businesses like Secureframe, Electives, and NEAR. With a seed-led approach, Accomplice helps early and late-stage startups scale and succeed in the ever-evolving tech industry.

8. Quiet Capital

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 365

- Number of Lead Investments: 39 (RWX, Einsite, etc)

- Location: San Francisco, CA

- Founded Year: 2017

- Investor Type: Venture Capital

Quiet Capital is a San Francisco-based venture capital firm that invests in promising technology startups. Since its founding in 2017, it has backed 365 companies, leading 39 key investments, including RWX and Einsite. With a focus on early and late-stage ventures, Quiet Capital helps tech innovators grow and thrive in a fast-changing industry.

9. Foundry Group

- Investment Stage: Convertible Note, Early Stage Venture, Late Stage Venture, Private Equity, Seed, Venture

- Number of Companies Invested: 364

- Number of Lead Investments: 199 (SingleFile Technologies, Canvas, Projector, etc)

- Location: Boulder, CO

- Founded Year: 2007

- Investor Type: Venture Capital

Foundry Group is a Boulder-based venture capital firm that supports early-stage technology startups. Since 2007, it has invested in 364 companies, leading 199 key deals, including SingleFile Technologies, Canvas, and Projector. With a focus on innovation, Foundry Group helps tech entrepreneurs build and scale businesses that shape the future of the industry.

10. Connecticut Innovations

- Investment Stage: Debt, Early Stage Venture, Grant, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 328

- Number of Lead Investments: 107 (Shelf, Invixium, Phlatbed, etc)

- Location: Rocky Hill, CT

- Founded Year: 1995

- Investor Type: Government Office, Venture Capital, Venture Debt

Connecticut Innovations is a venture capital firm based in Rocky Hill, CT, that has been fueling high-tech startups since 1995. With 328 investments and 107 lead deals, including Shelf, Invixium, and Phlatbed, it provides strategic capital and expert guidance to help companies grow and succeed in the ever-evolving technology industry.

11. Ignition Partners

- Investment Stage: Early Stage Venture

- Number of Companies Invested: 315

- Number of Lead Investments: 102 (Shyft Technologies, Visible Technologies, Clearsight Systems, etc)

- Location: Los Altos, CA

- Founded Year: 2000

- Investor Type: Venture Capital

Ignition Partners is a venture capital firm based in Los Altos, CA, that has been supporting visionary entrepreneurs since 2000. With 315 investments and 102 lead deals, including Shyft Technologies, Visible Technologies, and Clearsight Systems, the firm is dedicated to helping startups turn bold ideas into successful technology businesses.

12. EXPERT DOJO

- Investment Stage: Early Stage Venture, Seed

- Number of Companies Invested: 306

- Number of Lead Investments: 134 (iTechGenic Global, Hyperion Labs, Flutter Connect, etc)

- Location: Santa Monica, CA

- Founded Year: 2014

- Investor Type: Accelerator, Venture Capital

EXPERT DOJO, located in Santa Monica, CA, is a global startup accelerator that has been helping tech entrepreneurs grow since 2014. With 306 investments and 134 lead deals, including iTechGenic Global, Hyperion Labs, and Flutter Connect, they focus on providing early-stage support and guidance to innovative IT startups ready to scale.

13. Ulu Ventures

- Investment Stage: Early Stage Venture, Seed

- Number of Companies Invested: 297

- Number of Lead Investments: 42 (AVATOUR, Apomaya, Leadsales, etc)

- Location: Palo Alto, CA

- Founded Year: 2008

- Investor Type: Micro VC, Venture Capital

Ulu Ventures, based in Palo Alto, CA, is a seed-stage venture fund that specializes in backing innovative IT startups. Since its founding in 2008, the firm has invested in 297 companies, with 42 lead investments, including AVATOUR, Apomaya, and Leadsales. Ulu Ventures helps early-stage companies scale with its deep expertise and strategic support.

14. TEDCO

- Investment Stage: Debt, Early Stage Venture, Seed

- Number of Companies Invested: 249

- Number of Lead Investments: 155 (EBO, ReBokeh, Sciens Innovations, etc)

- Location: Columbia, MD

- Founded Year: 1998

- Investor Type: Government Office, Venture Capital

TEDCO, based in Columbia, MD, is a venture capital firm and government-backed organization that supports researchers, entrepreneurs, and startups in the IT sector. Since 1998, it has invested in 249 companies, leading 155 investments, including EBO, ReBokeh, and Sciens Innovations. TEDCO helps early-stage companies grow with funding, guidance, and strategic support.

15. Rev1 Ventures

- Investment Stage: Convertible Note, Early Stage Venture, Grant, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 243

- Number of Lead Investments: 61 (HubiFi, Rhyme, Ambassador Software Works, etc)

- Location: Columbus, OH

- Founded Year: 2005

- Investor Type: Corporate Venture Capital, Venture Capital

Rev1 Ventures, founded in 2005 and based in Columbus, OH, is a venture capital and corporate venture firm that works as both an investor and a startup studio. They focus on information technology and support startups through a mix of strategic services and funding. With investments in 243 companies and 61 lead deals—including HubiFi, Rhyme, and Ambassador Software Works—Rev1 plays a key role in helping early-stage businesses scale and helping corporations innovate. They invest across multiple stages, including convertible notes, seed, early to late-stage ventures, and grants, making them a flexible partner for growing companies.

16. MaC Venture Capital

- Investment Stage: Early Stage Venture, Seed, Venture

- Number of Companies Invested: 242

- Number of Lead Investments: 77 (FullyRamped, Blaze.tech, Mansa, etc)

- Location: Abilene, TX

- Founded Year: 2019

- Investor Type: Micro VC, Venture Capital

MaC Venture Capital, founded in 2019 and based in Abilene, TX, is a micro VC and venture capital firm focused on early-stage and seed investments. With a mission to back ideas, technologies, and products that can truly catch on, MaC Venture Capital has invested in 242 companies and led 77 of those deals—including FullyRamped, Blaze.tech, and Mansa. The firm is passionate about supporting bold founders in the information technology space and helping them grow their innovations into impactful businesses. Their hands-on approach and sharp eye for emerging trends make them a standout player in the venture capital world.

17. Freestyle Capital

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 219

- Number of Lead Investments: 57 (Opsmatic, Inspectiv, UXPin, etc)

- Location: San Francisco, CA

- Founded Year: 2009

- Investor Type: Venture Capital

Freestyle Capital is a San Francisco-based venture capital firm that has been backing early-stage technology startups since 2009. Focused on seed and venture funding, the firm has invested in 219 companies and led 57 deals, including Opsmatic, Inspectiv, and UXPin. Freestyle Capital helps founders build strong, innovative businesses in the information technology space by offering both capital and hands-on support. Their mission is to partner early and grow with companies as they shape the future of tech.

18. OUP (Osage University Partners)

- Investment Stage: Early Stage Venture, Late Stage Venture, Post-IPO, Seed, Venture

- Number of Companies Invested: 219

- Number of Lead Investments: 11 (Opsys Tech, Quintessent, etc)

- Location: Bala Cynwyd, PA

- Founded Year: 2009

- Investor Type: University Program, Venture Capital

OUP (Osage University Partners) is a venture capital firm based in Bala Cynwyd, PA, that supports startups turning university research into real-world technology. Since 2009, OUP has invested in 219 companies, with 11 lead deals including Opsys Tech and Quintessent. Focused on information technology and innovation, OUP partners closely with top universities to help transform cutting-edge ideas into powerful businesses. With investments across all stages—from seed to post-IPO—OUP plays a key role in bringing research-driven tech to life.

19. BlueRun Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed

- Number of Companies Invested: 217

- Number of Lead Investments: 69 (Breeze Intelligence, CIONIC, etc)

- Location: San Mateo, CA

- Founded Year: 1998

- Investor Type: Venture Capital

BlueRun Ventures is a venture capital firm based in San Mateo, CA, that has been investing in technology since 1998. With a strong focus on mobile software, services, and financial tech, they support early to late-stage startups with big ideas. So far, they’ve invested in 217 companies and led 69 of those deals, including Breeze Intelligence and CIONIC. BlueRun Ventures helps turn smart tech ideas into real businesses by providing funding and guidance at every stage.

20. Pelion Venture Partners

- Investment Stage: Debt, Early Stage Venture, Late Stage Venture, Seed

- Number of Companies Invested: 214

- Number of Lead Investments: 69 (Redo, Presidio Identity, Astound, etc)

- Location: Salt Lake City, UT

- Founded Year: 1986

- Investor Type: Venture Capital

Pelion Venture Partners is a trusted venture capital firm based in Salt Lake City, UT, and has been helping startups grow since 1986. They focus on early-stage B2B software companies, especially those building smart solutions in the information technology space. Pelion has invested in 214 companies and led 69 key deals, backing innovative startups like Redo, Presidio Identity, and Astound. With decades of experience and a passion for tech, Pelion supports founders with the funding and guidance they need to succeed.

21. Boldstart Ventures

- Investment Stage: Seed

- Number of Companies Invested: 202

- Number of Lead Investments: 63 (Agentuity, Cape, Dylibso, etc)

- Location: Miami, FL

- Founded Year: 2010

- Investor Type: Micro VC, Venture Capital

Boldstart Ventures is a seed-stage venture capital firm based in Miami, FL, that partners with founders from the very beginning of their journey. Founded in 2010, Boldstart focuses on developer-first startups, infrastructure, and SaaS companies in the information technology space. With 202 investments and 63 lead deals in standout companies like Agentuity, Cape, and Dylibso, they bring both belief and experience to the table. Boldstart isn’t just an investor—they’re a true partner, helping early tech startups build from the ground up.

22. Valor Capital Group

- Investment Stage: Convertible Note, Debt, Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 201

- Number of Lead Investments: 71 (Buser, Akad Seguros, Sami, etc)

- Location: New York, NY

- Founded Year: 2011

- Investor Type: Venture Capital

Valor Capital Group is a venture capital firm based in New York that helps connect tech markets across the U.S., Latin America, and beyond. Founded in 2011, Valor is known for backing bold ideas and bridging borders to support global innovation. With over 200 investments and 71 lead deals—including companies like Buser, Akad Seguros, and Sami—they focus on early to late-stage startups in the information technology space. Valor is more than just an investor—they’re a key partner for founders looking to grow across regions.

23. Maverick Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 195

- Number of Lead Investments: 57 (Centivo, DECENT, CareHarmony, etc)

- Location: San Francisco, CA

- Founded Year: 2015

- Investor Type: Venture Capital

Maverick Ventures, based in San Francisco, is the venture capital arm of Maverick Capital. Since its founding in 2015, it has focused on investing in early-stage healthcare and technology-driven businesses. With over 190 investments, including lead roles in companies like Centivo, DECENT, and CareHarmony, Maverick Ventures supports innovative startups at the intersection of healthcare and technology. Their commitment to fostering growth in this dynamic space makes them a valuable partner for entrepreneurs aiming to make a lasting impact.

24. Avalon Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture, Post-IPO, Seed, Venture

- Number of Companies Invested: 185

- Number of Lead Investments: 57 (Centivo, DECENT, CareHarmony, etc)

- Location: La Jolla, CA

- Founded Year: 1983

- Investor Type: Venture Capital

Avalon Ventures, based in La Jolla, CA, is an early-stage venture capital firm that has been investing in innovative technology and life sciences companies since 1983. With a strong focus on information technology, Avalon has made over 185 investments, including lead roles in companies like Centivo and CareHarmony. The firm partners with visionary founders to help bring groundbreaking solutions to market, providing both capital and strategic guidance for growth. Avalon Ventures continues to be a key player in the tech and life sciences sectors, supporting the next wave of transformative innovations.

25. Starta VC

- Investment Stage: Convertible Note, Early Stage Venture, Seed, Venture

- Number of Companies Invested: 157

- Number of Lead Investments: 36 (Zuzan, Greenbar, Techshelf, etc)

- Location: New York, NY

- Founded Year: 2011

- Investor Type: Accelerator, Venture Capital

Starta VC, based in New York, NY, is a dynamic venture ecosystem that specializes in supporting early-stage tech startups. Founded in 2011, Starta focuses on identifying, nurturing, and funding promising talent in the tech industry. With over 150 investments, including lead roles in companies like Zuzan and Techshelf, Starta helps startups gain traction in the U.S. while preparing them to scale globally. Their hands-on approach provides not only capital but also strategic guidance, making Starta a key partner for entrepreneurs aiming to turn their innovative ideas into successful global businesses.

26. Zillionize

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 155

- Number of Lead Investments: 3 (PickTrace, etc)

- Location: Palo Alto, CA

- Founded Year: 2011

- Investor Type: Angel Group, Venture Capital

Zillionize, based in Palo Alto, CA, is a low-friction startup investor with a proven track record of supporting fast-growing tech companies. Founded in 2011, Zillionize has invested in over 150 companies, including leading startups like PickTrace. With a focus on early-stage and venture investments, Zillionize is dedicated to helping startups thrive with minimal barriers, providing both capital and strategic insight. Their hands-on approach and strong portfolio make them a trusted partner for tech innovators aiming to accelerate their growth and impact the industry.

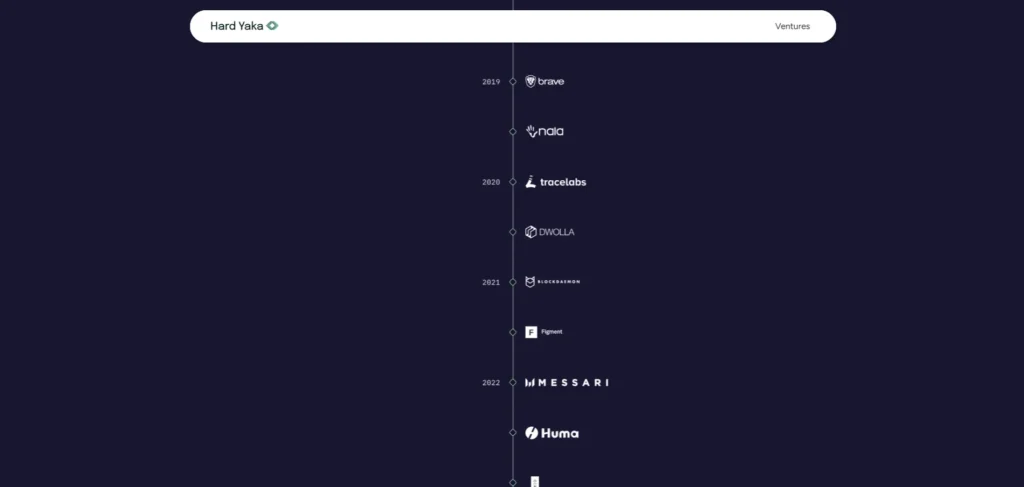

27. Hard Yaka

- Investment Stage: Early Stage Venture, Initial Coin Offering, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 155

- Number of Lead Investments: 8 (Indicio.tech, StandardC, Trace Labs, etc)

- Location: Crystal Bay, NV

- Founded Year: 2010

- Investor Type: Venture Capital

Hard Yaka, located in Crystal Bay, NV, is a venture capital firm that invests in innovative teams transforming how goods, services, and information are exchanged. Founded in 2010, Hard Yaka focuses on supporting early-stage and seed-stage companies that are revolutionizing industries through technology. With a portfolio that includes companies like Indicio.tech and Trace Labs, Hard Yaka helps startups push boundaries and create impactful solutions in the tech world. Their strategic support empowers entrepreneurs to bring bold ideas to life, shaping the future of global exchanges.

28. Chevron Technology Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture

- Number of Companies Invested: 152

- Number of Lead Investments: 16 (Mobilus Labs, etc)

- Location: Houston, TX

- Founded Year: 1999

- Investor Type: Corporate Venture Capital, Venture Capital

Chevron Technology Ventures, based in Houston, TX, is a venture capital firm focused on driving innovation and integrating emerging technologies within Chevron. Founded in 1999, the firm invests in early and late-stage companies that are pushing the boundaries of technology. With a portfolio that includes companies like Mobilus Labs, Chevron Technology Ventures champions the commercialization of groundbreaking ideas that enhance industries and create lasting impact. Their strategic investments aim to accelerate the development of solutions that align with Chevron’s commitment to innovation and efficiency in energy and beyond.

29. Borderless Capital

- Investment Stage: Early Stage Venture, Initial Coin Offering, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 149

- Number of Lead Investments: 54 (NodeKit, PROPS, peaq, etc)

- Location: Atlanta, GA

- Founded Year: 2018

- Investor Type: Accelerator, Fund Of Funds, Venture Capital

Borderless Capital, founded in 2018 and based in Atlanta, GA, is a Web3-native investment manager focused on fostering dynamic blockchain ecosystems. The firm primarily invests in early-stage ventures, seed, and late-stage projects, with a special emphasis on Initial Coin Offerings (ICOs). With a portfolio of 149 companies, including lead investments in projects such as NodeKit, PROPS, and peaq, Borderless Capital leverages its deep knowledge of blockchain technology to support transformative startups. Their goal is to drive innovation within the Web3 space by empowering companies that are shaping the future of decentralized platforms and digital economies.

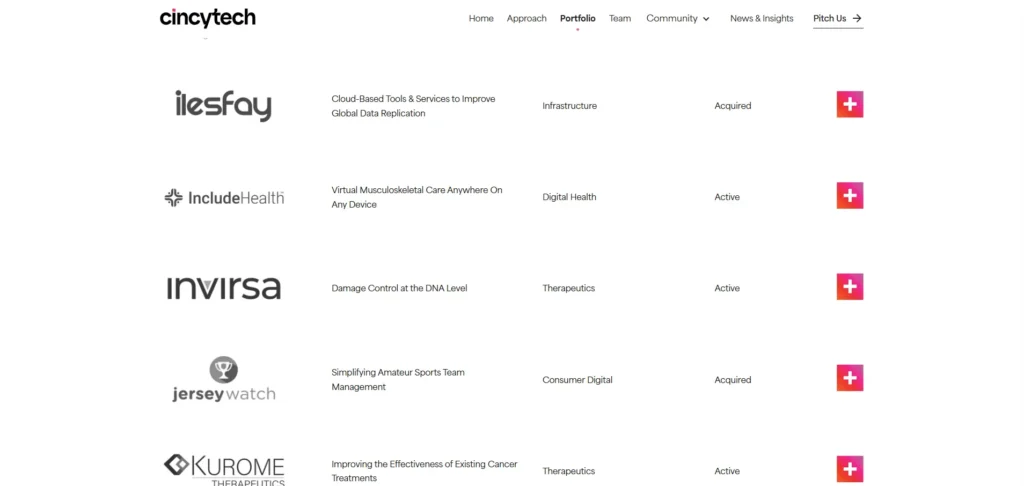

30. CincyTech

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 147

- Number of Lead Investments: 77 (Data Inventions, Ilesfay Technology Group, WorkFlex Solutions, etc)

- Location: Cincinnati, OH

- Founded Year: 2006

- Investor Type: Venture Capital

CincyTech, founded in 2006 and based in Cincinnati, OH, is one of the Midwest’s most active seed funds, focusing on disruptive human health and technology companies. With a strong portfolio of 147 investments, including lead roles in companies like Data Inventions, Ilesfay Technology Group, and WorkFlex Solutions, CincyTech is committed to backing innovative startups that are transforming the healthcare and technology sectors. The firm’s mission is to support early-stage ventures in Ohio, helping them scale and make a significant impact in their industries.

31. Moonshots Capital

- Investment Stage: Convertible Note, Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 147

- Number of Lead Investments: 26 (Yonder, Gretel, OnePercent.io, etc)

- Location: Austin, TX

- Founded Year: 2014

- Investor Type: Venture Capital

Moonshots Capital, founded in 2014 and based in Austin, TX, is a venture capital firm that believes in the power of great leadership. They focus on seed-stage investments and support startups with bold ideas and strong teams. With 147 companies in its portfolio and leading investments in exciting ventures like Yonder, Gretel, and OnePercent.io, Moonshots Capital backs early-stage tech companies that aim to make a big difference. Their approach is simple—invest in people who lead with vision and turn big ideas into reality.

32. Drive Capital

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 146

- Number of Lead Investments: 87 (Molecula, Gecko Robotics, etc)

- Location: Columbus, OH

- Founded Year: 2012

- Investor Type: Venture Capital

Drive Capital, founded in 2012 and based in Columbus, OH, is a venture capital firm that backs bold entrepreneurs who are building long-lasting businesses. With 146 investments and 87 lead deals—including standout names like Molecular and Gecko Robotics—Drive Capital focuses on supporting early to late-stage technology startups. They look for ideas with strong potential and help founders grow their companies into something big. Known for their long-term mindset, Drive Capital is all about turning innovative visions into real success.

33. Boston Millennia Partners

- Investment Stage: Early Stage Venture, Late Stage Venture, Private Equity, Seed, Venture

- Number of Companies Invested: 141

- Number of Lead Investments: 25 (Proteome, Reveleer, etc)

- Location: Boston, MA

- Founded Year: 1984

- Investor Type: Private Equity Firm, Venture Capital

Boston Millennia Partners, based in Boston, MA, is a seasoned venture capital and private equity firm that’s been investing since 1984. With 141 investments and 25 lead deals—including companies like Proteome and Reveleer—they focus on high-growth businesses in healthcare and business services, including information technology. Known for helping early to late-stage startups, they bring both funding and experience to the table. Their long track record and hands-on support make them a trusted partner for innovative companies ready to scale.

34. Amazon Alexa Fund

- Investment Stage: Convertible Note, Debt, Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 140

- Number of Lead Investments: 40 (Novalia, EX-IQ, Labrador Systems, etc)

- Location: Seattle, WA

- Founded Year: 2015

- Investor Type: Corporate Venture Capital, Venture Capital

The Amazon Alexa Fund, based in Seattle, WA, is a corporate venture capital arm of Amazon launched in 2015. With over 140 investments and 40 lead deals—including Novalia, EX-IQ, and Labrador Systems—it backs startups pushing the limits of voice technology. The fund offers up to $200 million to support early to late-stage companies working on smart, voice-powered innovations. Focused on information technology, it helps founders build the future of how we interact with devices using simple and natural speech.

35. WndrCo

- Investment Stage: Debt, Early Stage Venture, Late Stage Venture, Private Equity, Seed, Venture

- Number of Companies Invested: 137

- Number of Lead Investments: 11 (Yassir, Aura, etc)

- Location: Beverly Hills, CA

- Founded Year: 2017

- Investor Type: Venture Capital

WndrCo, based in Beverly Hills, CA, is a venture capital firm and holding company founded in 2017. With 137 investments and 11 lead deals—including Yassir and Aura—WndrCo focuses on building and supporting consumer technology businesses. They don’t just invest; they also help grow and operate these companies for the long haul. Whether it’s early-stage startups or more mature tech ventures, WndrCo aims to shape the future of how we use and experience technology in everyday life.

36. Titanium Ventures

- Investment Stage: Early Stage Venture, Late Stage Venture, Venture

- Number of Companies Invested: 136

- Number of Lead Investments: 46 (Algoblu, Cumulus Networks, Rancher Labs, etc)

- Location: San Francisco, CA

- Founded Year: 2011

- Investor Type: Venture Capital

Titanium Ventures, based in San Francisco and founded in 2011, is a venture capital firm focused on growing tech companies. With 136 investments and 46 lead deals—including Algoblu, Cumulus Networks, and Rancher Labs—they back bold ideas in information technology. What sets them apart is their focus on creating real business value through synergy revenues, helping startups grow faster and smarter. Titanium Ventures isn’t just about funding—it’s about building strong, lasting tech partnerships.

37. Thomvest Ventures

- Investment Stage: Debt, Early Stage Venture, Late Stage Venture, Post-IPO, Private Equity, Secondary Market, Seed

- Number of Companies Invested: 134

- Number of Lead Investments: 34 (StackGen, Avalanche Technology, ShieldX Networks, Inc., etc)

- Location: San Francisco, CA

- Founded Year: 1996

- Investor Type: Venture Capital

Thomvest Ventures, founded in 1996 and based in San Francisco, is a venture capital firm that supports tech companies at every stage of growth. With 134 investments and 34 lead deals—including StackGen, Avalanche Technology, and ShieldX Networks—they bring both funding and experience to the table. Thomvest is known for its flexible approach, offering support from seed to post-IPO and even in private equity and debt rounds. They aim to be a steady partner, helping bold ideas grow into strong, successful businesses in the world of information technology.

38. HLM Venture Partners

- Investment Stage: Debt, Early Stage Venture, Late Stage Venture, Post-IPO, Seed, Venture

- Number of Companies Invested: 134

- Number of Lead Investments: 39 (Aventura Software, Sanovia Corporation, Silverlink Communications, Inc., etc)

- Location: Boston, MA

- Founded Year: 1983

- Investor Type: Venture Capital

HLM Venture Partners, based in Boston and founded in 1983, is a venture capital firm that backs cutting-edge healthcare technology companies. With 134 investments and 39 lead deals—like Aventura Software, Sanovia Corporation, and Silverlink Communications—they focus on helping startups grow and make a real impact. HLM supports companies from the early stages through IPO and beyond, combining deep industry knowledge with smart funding. Their goal is to build strong, lasting businesses that improve how healthcare and technology work together.

39. March Capital

- Investment Stage: Early Stage Venture, Late Stage Venture

- Number of Companies Invested: 132

- Number of Lead Investments: 60 (Absurd:Joy, Coho Data, Astound, etc)

- Location: Santa Monica, CA

- Founded Year: 2014

- Investor Type: Venture Capital

March Capital, founded in 2014 and based in Santa Monica, is a venture capital firm focused on the future of cloud-based software. With 132 investments and 60 lead deals—including companies like Absurd:Joy, Coho Data, and Astound—they back bold founders driving digital transformation. March Capital supports startups in both early and late stages, helping them scale fast and smart. Its mission is to fund innovative tech that changes how the world works, one breakthrough at a time.

40. Toba Capital

- Investment Stage: Early Stage Venture, Late Stage Venture, Private Equity, Seed, Venture

- Number of Companies Invested: 129

- Number of Lead Investments: 52 (Clear Skye, Restless Bandit, Quorum, etc)

- Location: San Francisco, CA

- Founded Year: 2012

- Investor Type: Venture Capital

Toba Capital, founded in 2012 and based in San Francisco, is a venture capital firm focused on building great technology companies. With 129 investments and 52 lead deals—including Clear Skye, Restless Bandit, and Quorum—Toba backs startups from seed to growth stage. They look for passionate teams with bold ideas and help them turn smart tech into lasting success. Toba Capital’s mission is simple: invest in people who are ready to build something incredible.

41. Tech Square Ventures

- Investment Stage: Convertible Note, Early Stage Venture, Seed, Venture

- Number of Companies Invested: 127

- Number of Lead Investments: 18 (Pointivo, Slope Software, Danti, etc)

- Location: Atlanta, GA

- Founded Year: 2014

- Investor Type: Venture Capital

Tech Square Ventures, founded in 2014 and based in Atlanta, is a venture capital firm that focuses on seed and early-stage investments in enterprise, marketplace, platform, and tech-enabled services. With 127 investments and 18 lead deals, including companies like Pointivo, Slope Software, and Danti, they support visionary founders shaping the future of technology. Tech Square Ventures is dedicated to helping innovative startups grow by providing the capital and resources they need to succeed in a competitive tech landscape.

42. AllegisCyber

- Investment Stage: Early Stage Venture, Late Stage Venture, Seed, Venture

- Number of Companies Invested: 123

- Number of Lead Investments: 34 (Axcient, Symplified, ActiveGrid, etc)

- Location: San Francisco, CA

- Founded Year: 1996

- Investor Type: Venture Capital

AllegisCyber, founded in 1996 and based in San Francisco, is a venture capital firm that invests in early-stage companies focused on developing innovative technology and software for emerging markets. With 123 investments and 34 lead deals, including notable names like Axcient, Symplified, and ActiveGrid, AllegisCyber is dedicated to helping startups scale and thrive in the ever-evolving tech landscape. Their focus on disruptive technologies ensures they partner with visionary companies that are shaping the future of industries around the globe.

43. Playground Global

- Investment Stage: Early Stage Venture

- Number of Companies Invested: 119

- Number of Lead Investments: 54 (Phasecraft, Canvas Technology, etc)

- Location: Palo Alto, CA

- Founded Year: 2015

- Investor Type: Venture Capital

Playground Global, founded in 2015 and based in Palo Alto, is an early-stage venture capital firm that specializes in deep tech investments. With a focus on supporting technical and scientific founders, Playground backs innovative companies that push the boundaries of technology. Having invested in 119 companies, including lead investments in Phasecraft and Canvas Technology, the firm is dedicated to fueling breakthroughs in fields that shape the future. Playground Global is passionate about partnering with visionary entrepreneurs to bring cutting-edge solutions to life.

Conclusion

These VC firms are driving innovation in the IT sector by funding the technologies of tomorrow. Their investments not only support startups but also shape the future of digital transformation. Staying updated on these key players can provide valuable insights for founders, investors, and tech enthusiasts alike.

FAQs

Q. Are early-stage IT startups likely to get VC funding?

Answer: Yes, many VC firms focus on seed or Series A rounds for early-stage IT startups, especially if they show high growth potential and a unique value proposition.

Q. What are the top VC firms investing in Information Technology?

Answer: Firms like Sequoia Capital, Andreessen Horowitz, Accel, and Lightspeed Venture Partners are among the most active investors in IT startups.

Q. Why is the IT sector attractive to VC investors?

Answer: The IT sector offers high scalability, rapid innovation, and the potential for large returns, making it a prime target for venture capital investment.